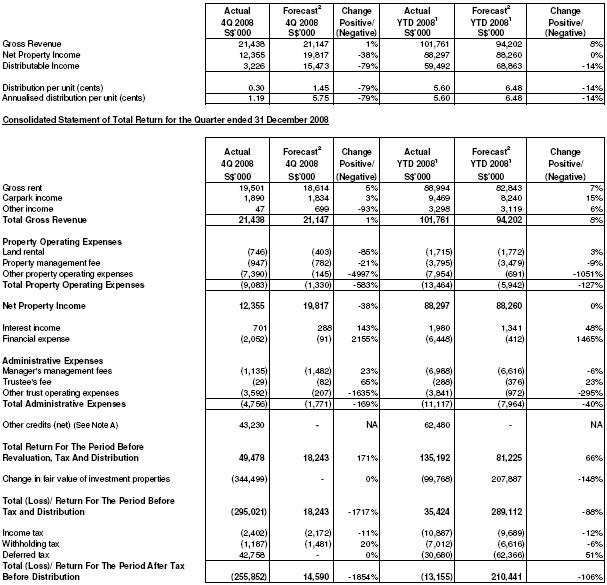

Financial Results

2008 FOURTH QUARTER UNAUDITED FINANCIAL STATEMENTS AND DISTRIBUTION ANNOUNCEMENT ENDED 31 DECEMBER 2008

General Footnote:

- YTD 2008 includes private trust period from 8 August 2007 to 18 November 2007 ("Private Trust Period") and public trust period from 19 November 2007 ("Listing Date") to 31 December 2008.

- The forecast is based on forecast as shown in the Prospectus.

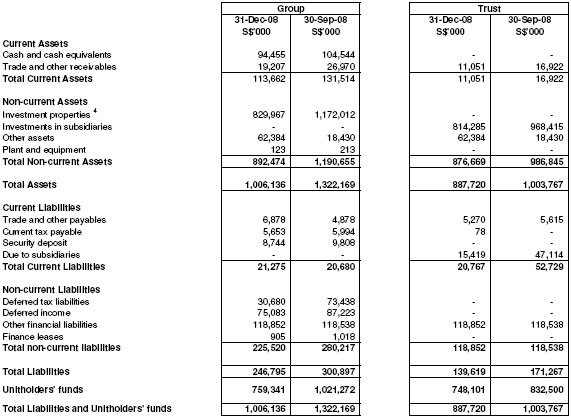

Balance Sheet

General Footnote:

- YTD 2008 includes private trust period from 8 August 2007 to 18 November 2007 ("Private Trust Period") and public trust period from 19 November 2007 ("Listing Date") to 31 December 2008.

- The forecast is based on forecast as shown in the Prospectus.

- The return of capital comprises the amounts received by LMIR Trust from the redemption of its investment in the redeemable preference shares in the Singapore SPCs.

- The carrying values of the properties are stated based on the independent valuation as of 30 November 2008.

- Comparative Investment properties and Plant and equipment have been restated to be consistent with current quarter's presentation.

Review of Performance

Fourth Quarter Performance

Overall, distribution to unit holders for the fourth quarter is S$3.2 M, which is S$12.3 M or 79% below the forecast for the same period. Gross revenue for the period is S$21.4 M. Excluding Sun Plaza, gross revenue is S$17.6 M, which is S$3.5 M below forecast, due to the expiry and early termination of lease rental by some tenants.

Property operating expenses for the quarter are S$9.1 M, which is S$7.8 M above forecast. The increase is due mainly to (1) allowance for outstanding receivables of S$7.0 M, (2) higher land rental of S$0.3 M arising mainly from the land rental payment for Plaza Semanggi, (3) additional property management fee arising from the addition of the Sun Plaza property, which contributed S$0.2 M and (4) higher operating expenses of S$0.2 M. The S$7.0 M receivables comprise of outstanding rent from wholesaler tenants. These tenants have given notice of termination of their leases. The Manager considers these tenants to be in breach of their contractual obligations and will engage all legal means to recover the debts. However, as a measure of prudence, the Manager has decided to make specific provisions for the total amount outstanding.

The lower gross revenue and higher property operating expenses resulted in the net property income being S$7.4 M, or 38%, lower than forecast.

An interest income of S$0.7 M is earned from the surplus of funds placed in deposits with banks. The financial expense of S$2.1 M is mainly the interest cost arising from the S$125 M loan which was drawndown for the acquisition of the Sun Plaza property.

The management fee of S$1.1 M, which is S$0.4 M lower than forecast, is due mainly to the lower net property income.

Other trust operating expenses are higher by S$3.6 M, due mainly to the writing off of the arrangement fee for Deutsche Bank term loan facility B of S$225 million. This loan facility, together with another S$125 M loan facility A, comprises the total original proposed loan arrangement of S$350 M with Deutsche Bank. LMIR Trust had utilised the loan facility A of S$125 M in March 2008. LMIR Trust has paid an upfront fee of S$2.8 M to Deutsche Bank to syndicate facility B by Sep 2009. The Manager will focus on organic growth for 2009 and asset acquisitions are unlikely. Coupled with the challenging credit environment, the Manager has, as a measure of prudence, decided to write off the S$2.8 M fee. In addition, the amount of S$0.5 M comprising the legal fee for facility B will also be written off.

Total loss for the period after tax but before distribution is S$255.9 M, which is S$270.5 M below forecast. This is due mainly to deficit of S$301.7 M (net of deferred tax) arising from the change in fair value of the investment properties, a significant portion of which is due to the depreciation of Indonesian Rupiah against the Singapore Dollar. LMIR Trust does not have a policy of hedging capital values which does not impact distribution to unit holders. The deficit in the change in fair value of the investment properties is a non-cash item and has no impact on cashflow or distribution. Indonesian Rupiah income is, however, substantially hedged in Singapore Dollar. This has resulted in an unrealised exchange gain of S$46.2 M on the forward hedging contract relating to cashflow from the Indonesian operations.

In view of the above, distribution to unit holders is S$3.2 M, which translates into a distribution per unit of 0.30 cent, as compared to the forecast of 1.45 cent.

Full Year PerformanceOverall, distribution to unit holders for the year is S$59.5 M, which is S$9.4 M or 14% below the forecast for the same period.

Total gross revenue for the year at S$101.8 M, is S$7.6 M higher than forecast, due mainly to the contribution from the Sun Plaza property which was acquired on 31 March 2008.

Property operating expenses for the year are S$13.5 M, which is S$7.6 M above forecast. The increase is due mainly to the allowance for outstanding receivables of S$7.0 M, additional property management fee arising from the addition of the Sun Plaza property which contributed S$0.3 M and higher operating expenses of S$0.2 M.

The higher gross revenue resulted in the net property income for the year at S$88.3 M, which is in line with the forecast.

An interest income of S$2.0 M is earned from the surplus of funds placed in deposits with banks for the year. The financial expense of S$6.4 M is mainly the interest cost arising from the S$125 M loan which was drawndown for the acquisition of the Sun Plaza property.

The management fee of S$7.0 M, which is S$0.4 M higher than forecast, is due to the additional fees payable for the Sun Plaza property.

Other trust operating expenses of S$3.8 M, are higher by S$2.9 M, due mainly to the writing off of the arrangement fee for Deutsche Bank term loan facility B.

Total loss for the year after tax but before distribution is S$13.2 M, which is S$223.6 M below forecast. The deficit of S$99.8 M arising from the change in fair value of the investment properties resulted in an unfavourable S$307.7 M when compared to the forecast. As stated above, this has no impact on cashflow or distribution. However, hedging of the cashflow in Indonesian Rupiah resulted in an unrealised foreign exchange gain of S$63.9 M.

Adjusting for the total non cash items of S$72.6 M, distribution to unit holders for the period is S$59.5 M, which is S$9.4 M or 14% below the forecast. This translates into a distribution per unit of 5.60 cents, as compared to the forecast of 6.48 cents.

As at 31 December 2008, the gearing is 12.4%. LMIR Trust has a term loan of S$125 M which is repayable after 5 years from 26 March 2008.

Commentary

Indonesia's GDP is expected to grow 6.2%1 for 2008, compared to the growth of 6.3% in 2007. Inflation continued to be concern and increased from 6.59% in Dec 2007 to 11.06%2 in December 2008, driven by higher cost of food, fuel and rising commodity prices. However, inflation is predicted to ease to 5%-7% in 2009.

As at September 2008, the total retail space in Jakarta increased slightly by 0.27 million square metres to 3.37 million square metres from 3.10 million square metres in June 2008. The overall ocupancy rate increased from 87.6% to 88.75% during the third quarter of 20083.

Outlook for 2009The outlook for 2009 will be challenging. With the global economic slowdown, retail space demand is expected to weaken and competition among landlords to intensify. Rents are expected to be under pressure. The strategy of the Manager is to focus on organic growth through proactive asset management to maintain high occupancy, and prudent capital management by conserving cash through tight controls over operating and capital expenditure.

Note:- www.indonesia.go.id 13 January 2009

- Bank Indonesia Report

- Colliers International "The Knowldege" November 2008

Click here for 4Q Full Financial Report

Click here for 3Q Financial Result