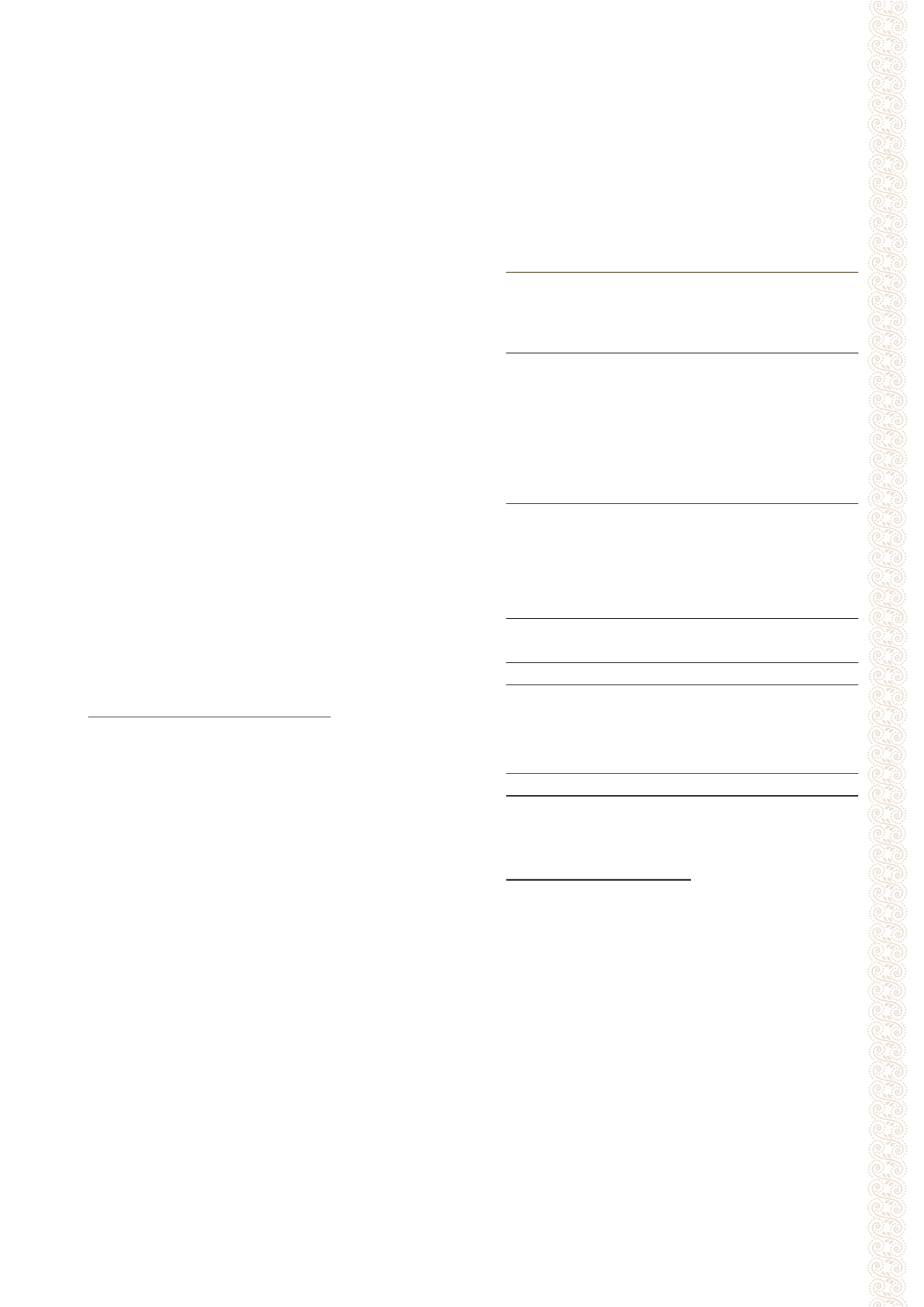

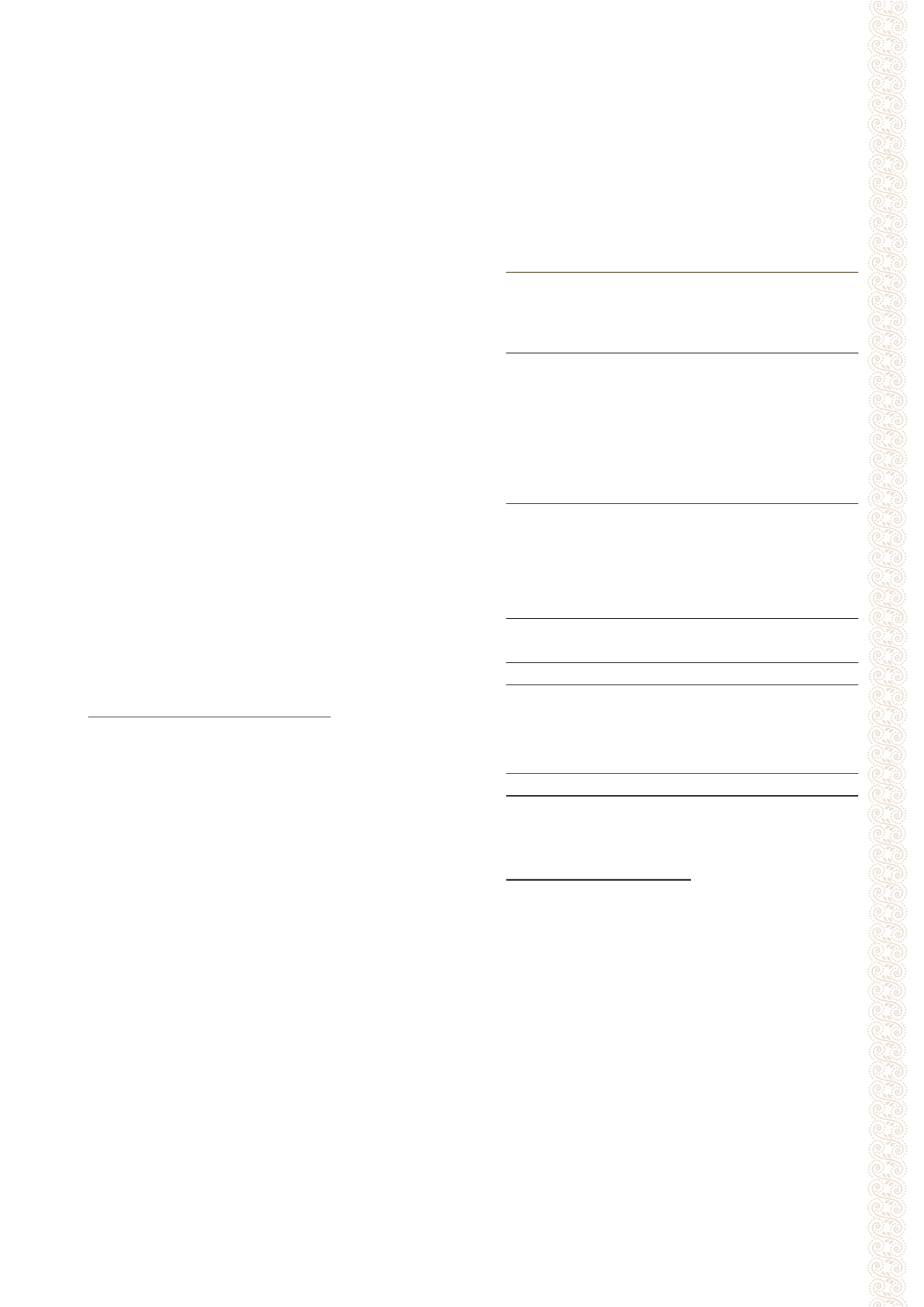

55

LIPPO MALLS INDONESIA RETAIL TRUST ANNUAL REPORT 2014

Group

Trust

Notes

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Gross revenue

4

136,985

152,599

81,564

86,016

Property operating expenses

5

(10,978)

(9,239)

–

–

Net property income

126,007

143,360

81,564

86,016

Interest income

2,925

1,687

541

–

Other gains

6

642

3,645

558

3,645

Manager’s management fees

7

(9,408)

(10,349)

(9,408)

(10,349)

Trustee’s fees

(300)

(322)

(300)

(322)

Finance costs

8

(34,409)

(30,602)

(34,583)

(30,373)

Other expenses

9

(1,355)

(1,470)

(1,265)

(1,132)

Net income before the undernoted

84,102

105,949

37,107

47,485

Increase/(decrease) in fair values of investment properties

14

4,536

(24,022)

–

–

Realised gains/(losses) on derivative financial instruments

7,454

(8,409)

7,454

(8,409)

Increase in fair values of derivative financial instruments

26

221

9,492

221

9,492

Realised foreign exchange adjustment losses

(5,035)

(3,542)

(5,221)

(3,791)

Unrealised foreign exchange adjustment (losses)/gains

(1,363)

1,627

2,869

(23,767)

Total return for the year before income tax

89,915

81,095

42,430

21,010

Income tax expenses

10

(26,093)

(10,655)

(367)

(1,721)

Total return for the year after income tax

63,822

70,440

42,063

19,289

Other comprehensive return/(loss):

Items that may be reclassified subsequently to

profit or loss:

Exchange differences on translating foreign operations

52,467

(321,109)

–

–

Total comprehensive return/(loss)

116,289

(250,669)

42,063

19,289

Cents

Cents

Earnings per unit in cents

Basic and diluted earnings per unit

11

2.59

3.17

Statements of Total Return

Year Ended 31 December 2014

The accompanying notes form an integral part of these financial statements.