96

LIPPO MALLS INDONESIA RETAIL TRUST ANNUAL REPORT 2014

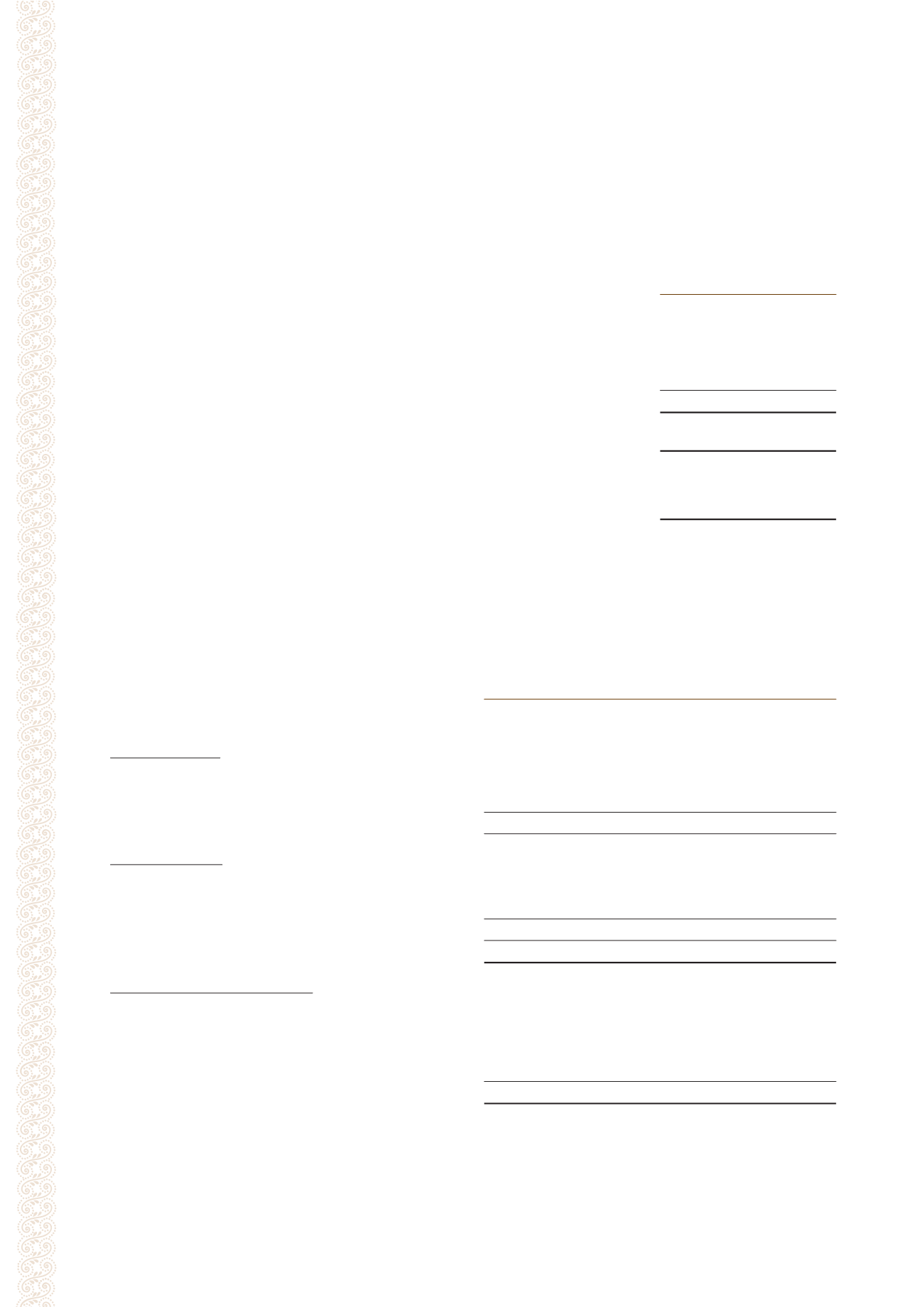

16. INVESTMENTS IN SUBSIDIARIES

Trust

2014

2013

$’000

$’000

Unquoted equity shares, at cost

981,423

918,441

Redeemable preference shares, at cost

716,852

437,467

Quasi equity loans

(1)

25,242

28,057

1,723,517 1,383,965

Net book value of subsidiaries

1,723,066 1,413,169

Analysis of above amount denominated in non-functional currency:

United States Dollars

5,882

8,741

Indonesian Rupiah

1,262,166 1,282,140

(1)

The quasi-equity loans are unsecured, interest-free loans to three Singapore subsidiaries with no fixed repayment terms. They are,

in substance, part of the Trust’s net investment in the subsidiaries.

The list of the subsidiaries is in Note 37.

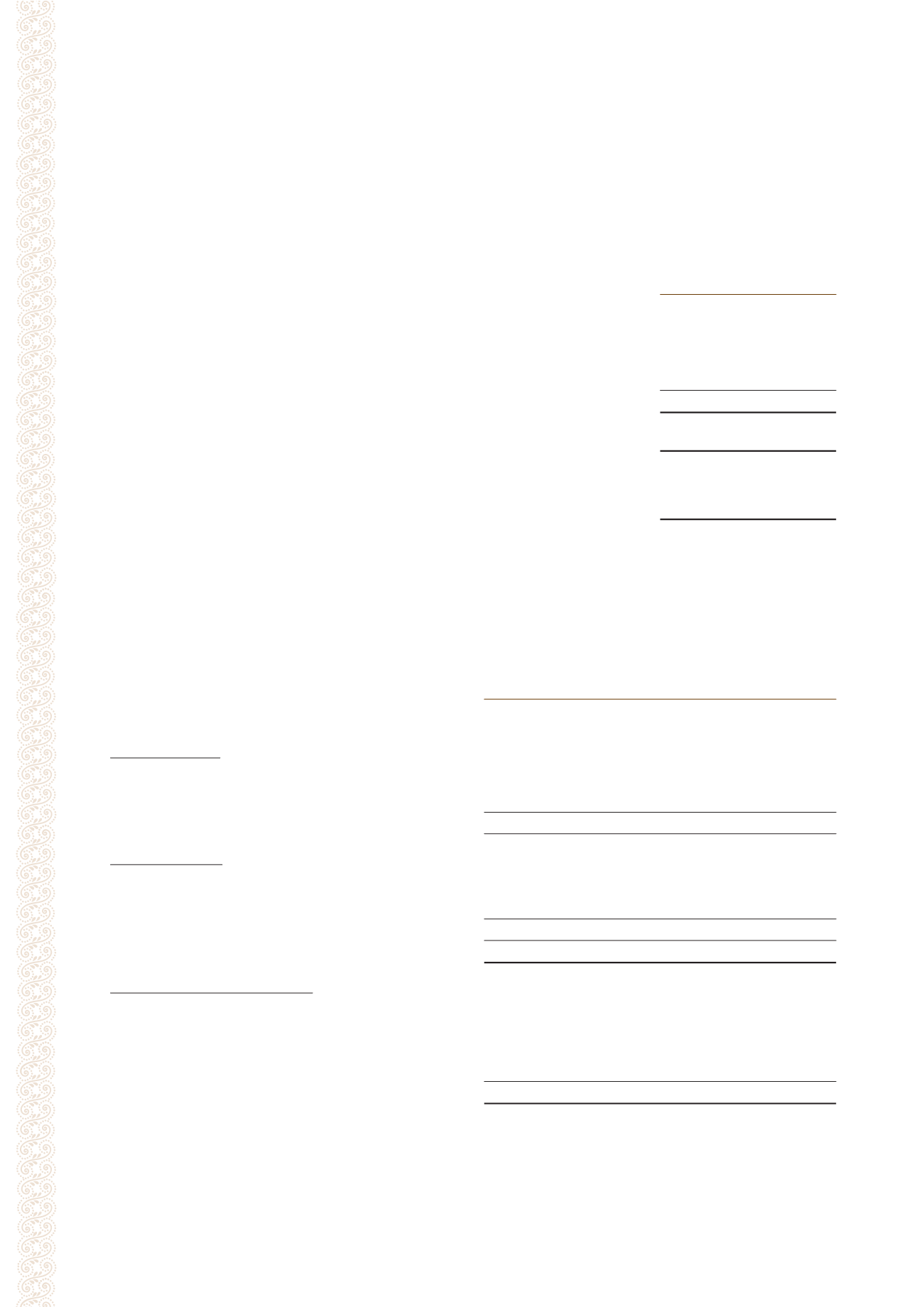

17. TRADE AND OTHER RECEIVABLES, CURRENT

Group

Trust

2014

2013

2014

2013

$’000

$’000

$’000

$’000

Trade receivables:

Outside parties

4,442

4,654

448

557

Less: Allowance for impairment

(310)

(298)

–

–

Related parties (Note 3)

1,001

514

–

–

Subtotal

5,133

4,870

448

557

Other receivables:

Subsidiaries (Note 3)

(1)

–

–

189,146

254,297

Related parties (Note 3)

6,046

503

–

–

Other receivables

8,714

9,520

2,501

2,345

Subtotal

14,760

10,023

191,647

256,642

Total trade and other receivables

19,893

14,893

192,095

257,199

Movements in above allowance:

Balance at beginning of the year

(298)

(1,207)

–

–

Bad debt written-off

212

–

–

–

(Charge)/reversal for trade receivables to profit or loss

included in property operating expenses (Note 5)

(218)

743

–

–

Effect of changes in exchange rates

(6)

166

–

–

Balance at end of the year

(310)

(298)

–

–

(1)

Other receivables include the balance of net proceeds from issuance of units of $26,711,000 (2013: $97,700,000) received on behalf by

a wholly-owned subsidiary of the Trust.

Concentration of credit risk relating to trade receivables is limited due to the Group’s many varied tenants and credit

policy of obtaining security deposits from most tenants for leasing the Group’s investment properties. These tenants

comprise retailers engaged in a wide variety of consumer trades. The Group establishes an allowance for impairment

that represents its estimate of incurred losses in respect of trade receivables.

Notes to the Financial Statements

(Cont’d)

31 December 2014