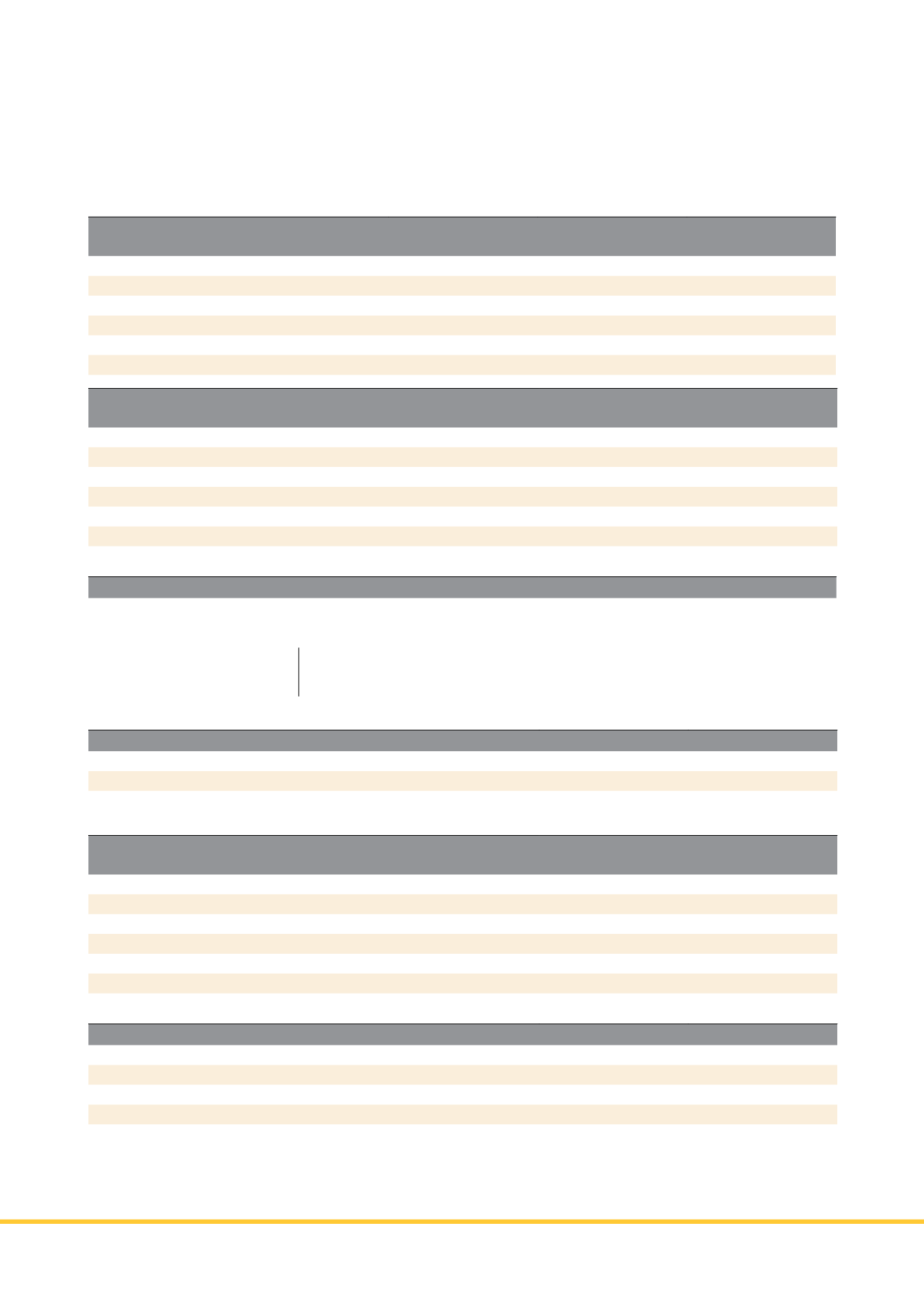

GROUP FINANCIAL

HIGHLIGHTS

Summary of Results

FY 2015

(S$’000)

FY 2014

(S$’000)

Change Favourable/

(Unfavourable)

Gross Rental Income

173,004

136,985

26.3%

Property Operating Expenses

(14,439)

(10,978)

-31.5%

Net Property Income

158,565

126,007

25.8%

Net Income Before tax

44,277

89,915

-50.8%

Distributable Income

85,553

68,014

25.8%

Distribution Per Unit (cents)

3.10

2.76

12.3%

Balance Sheet*

31-Dec-15

(S$’000)

31-Dec-14

(S$’000)

Non-current assets

1,837,285

1,845,885

Current assets

150,459

171,604

Total assets

1,987,744

2,017,489

Current liabilities

349,921

305,278

Non-current liabilities

562,708

562,481

Net assets

1,075,115

1,149,730

Net Asset Value (NAV)

31-Dec-15

31-Dec-14

Including fair value changes on investment properties (cents)

38.43

42.55

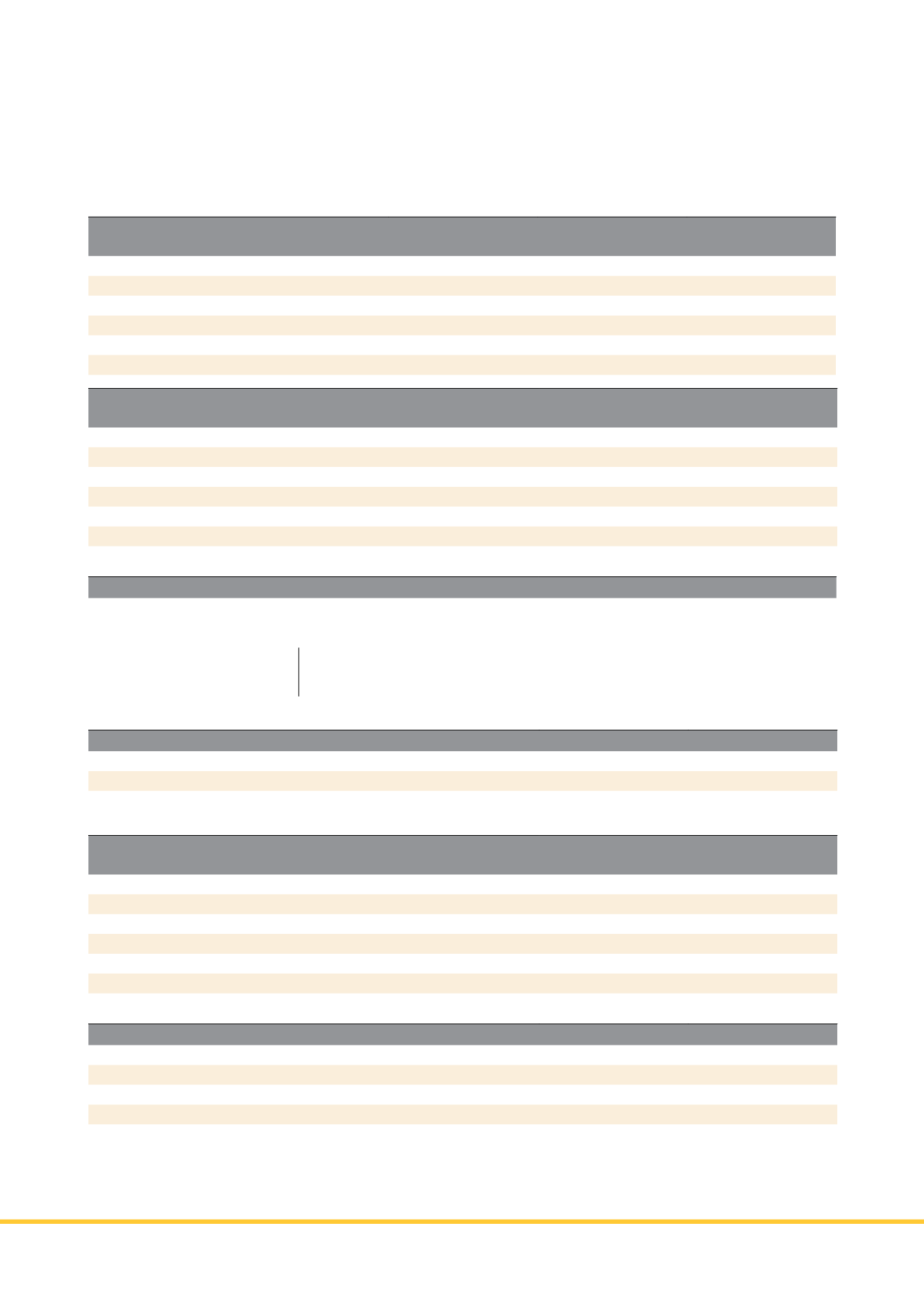

Financial Derivatives and Expenses

FY 2015

Net Fair Value of Financial Derivatives at end of period (S$'000)

1

1,219

Proportion of Financial Derivatives to Net Assets Attributable to Unitholders (%)

0.11

Total Operating Expenses (S$'000)

2

14,439

Total Operating Expenses as a percentage of Net Asset Value (%)

1.34

Taxation (S$'000)

3

17,829

1

Financial derivatives include currency option contracts and interest rate swaps

2

Total operating expenses includes all fees and charges paid to the Manager and interested parties

3

Taxation includes corporate tax, withholding tax and deferred tax

*

After taking into account interest swap contracts entered in 2015

** Fully repaid in January 2016

Debt Information

31-Dec-15

31-Dec-14

Term Loan Due December 2018 (All in cost of debt 5.57%*)

S$145 MILLION S$155 MILLION

Bridging Loan Due January 2016 (All in cost of debt 5.9%)

S$100 MILLION**

–

Notes issued under the Guaranteed Euro Medium Term Notes/

Securities Programmes

31-Dec-15

31-Dec-14

4.88% Due July 2015 (All in cost of debt: 5.2%)

***

S$200 MILLION

4.25% Due October 2016 (All in cost of debt: 5.0%)

S$150 MILLION S$150 MILLION

5.875% Due July 2017 (All in cost of debt: 6.7%)

S$50 MILLION

S$50 MILLION

4.48% Due November 2017 (All in cost of debt: 5.2%)

S$75 MILLION

S$75 MILLION

4.50% Due November 2018 (All in cost of debt: 4.9%)

S$100 MILLION

–

4.10% Due June 2020 (All in cost of debt: 4.5%)

S$75 MILLION

–

*** Fully repaid in July 2015

*

The exchange rates for FY2015 and FY2014 were 9,707 and 9,374, respectively

Gearing

35.0%

Gearing remained

conservative as at

31 December 2015

Interest Cover Ratio

4.8 TIMES

Refers to earnings before interest expense, tax, depreciation,

amortisation and changes in fair value of investment

properties (EBITDA), over interest expenses for FY 2015

LIPPO MALLS INDONESIA RETAIL TRUST

16