NOTES TO THE FINANCIAL STATEMENTS

(CONT’D)

31 DECEMBER 2015

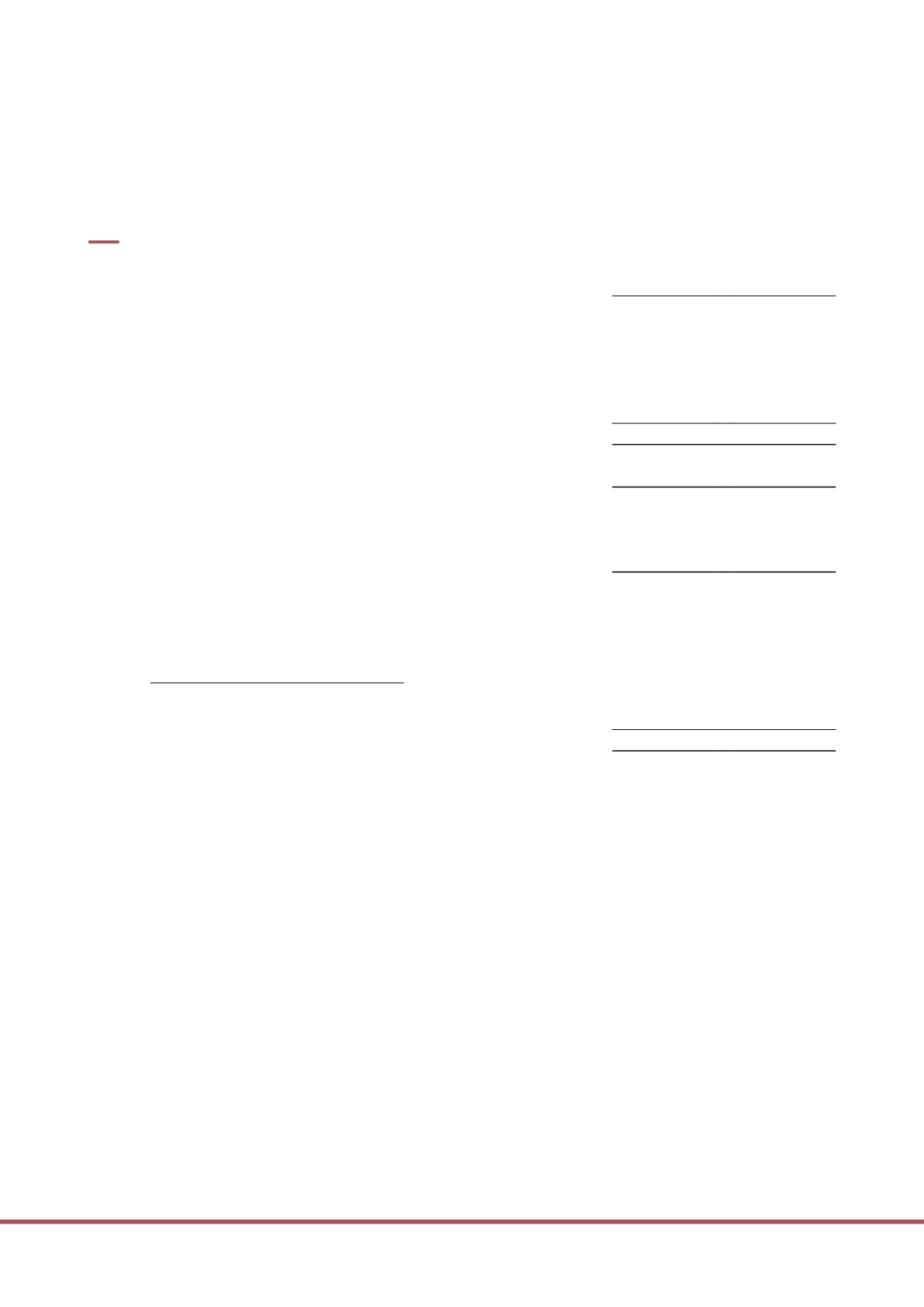

16.

INVESTMENTS IN SUBSIDIARIES

Trust

2015

2014

$’000

$’000

Unquoted equity shares, at cost

983,570

981,423

Redeemable preference shares, at cost

789,440

716,852

Quasi equity loans

(1)

22,938

25,242

Less: Allowance for impairment

(49,378)

–

1,746,570

1,723,517

Net book value of subsidiaries

1,670,902

1,723,066

Analysis of above amount denominated in non-functional currency:

United States Dollars

3,578

5,882

Indonesian Rupiah

1,223,752

1,262,166

(1)

The quasi-equity loans, which are extended to three Singapore subsidiaries, are unsecured and interest-

free with no fixed repayment terms. They are, in substance, part of the Trust’s net investment in the

subsidiaries.

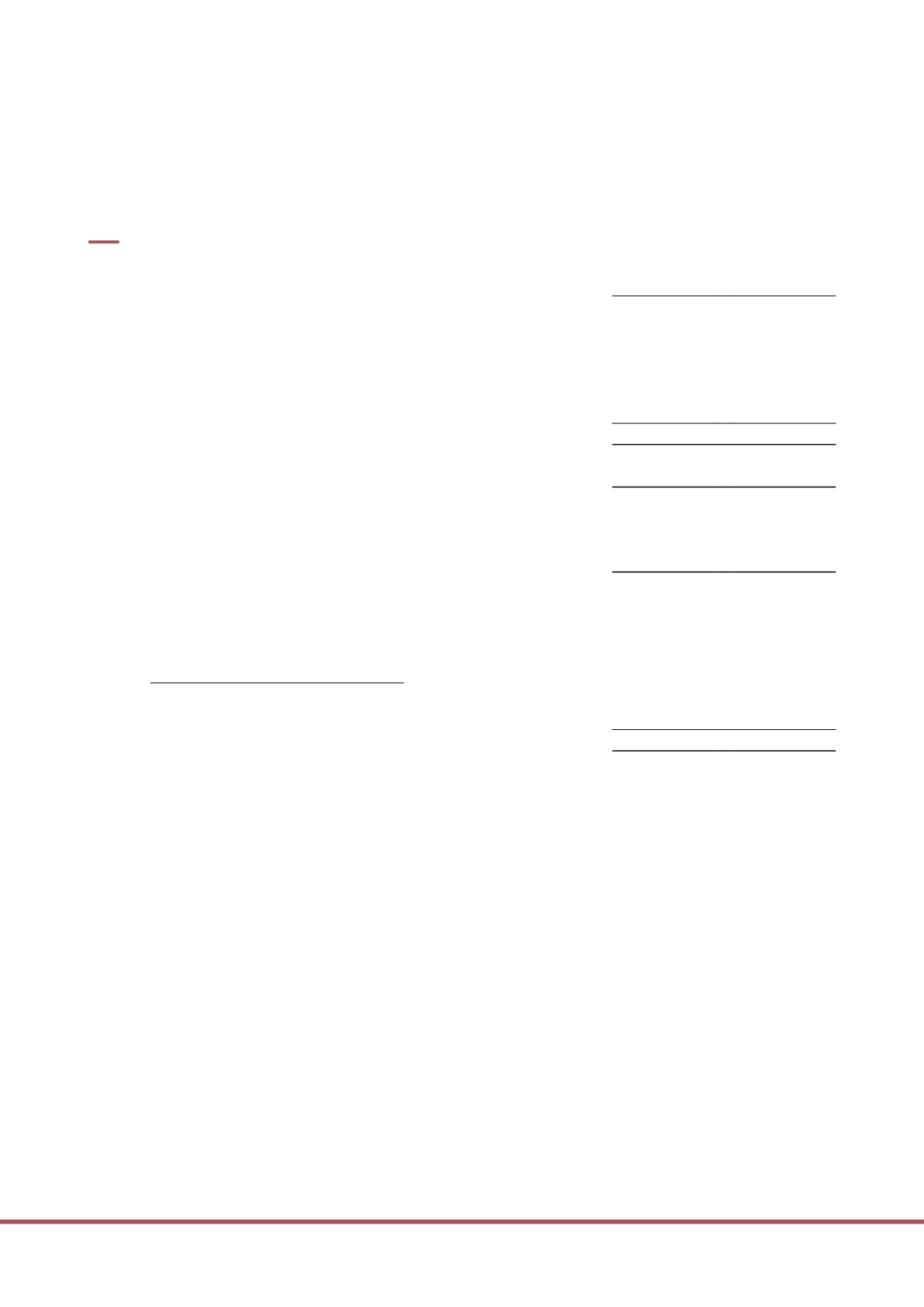

Movements in allowance for impairment:

Balance at beginning of the year

–

–

Impairment loss charged to profit or loss

(49,378)

–

Balance at the end of the year

(49,378)

–

The list of the subsidiaries is in Note 36.

The management has assessed that there are indicators of impairment for those subsidiaries with shortfalls

between the cost of investment translated at year-end rates and the revalued net asset value (“NAV”). Such

shortfalls would indicate that the NAV of these subsidiaries have declined against their costs. Based on the above

assessment, the management had made an allowance for impairment loss of $49,378,000 in the Trust’s financial

statements as at 31 December 2015.

ANNUAL REPORT 2015

107