NOTES TO THE FINANCIAL STATEMENTS

(CONT’D)

31 DECEMBER 2015

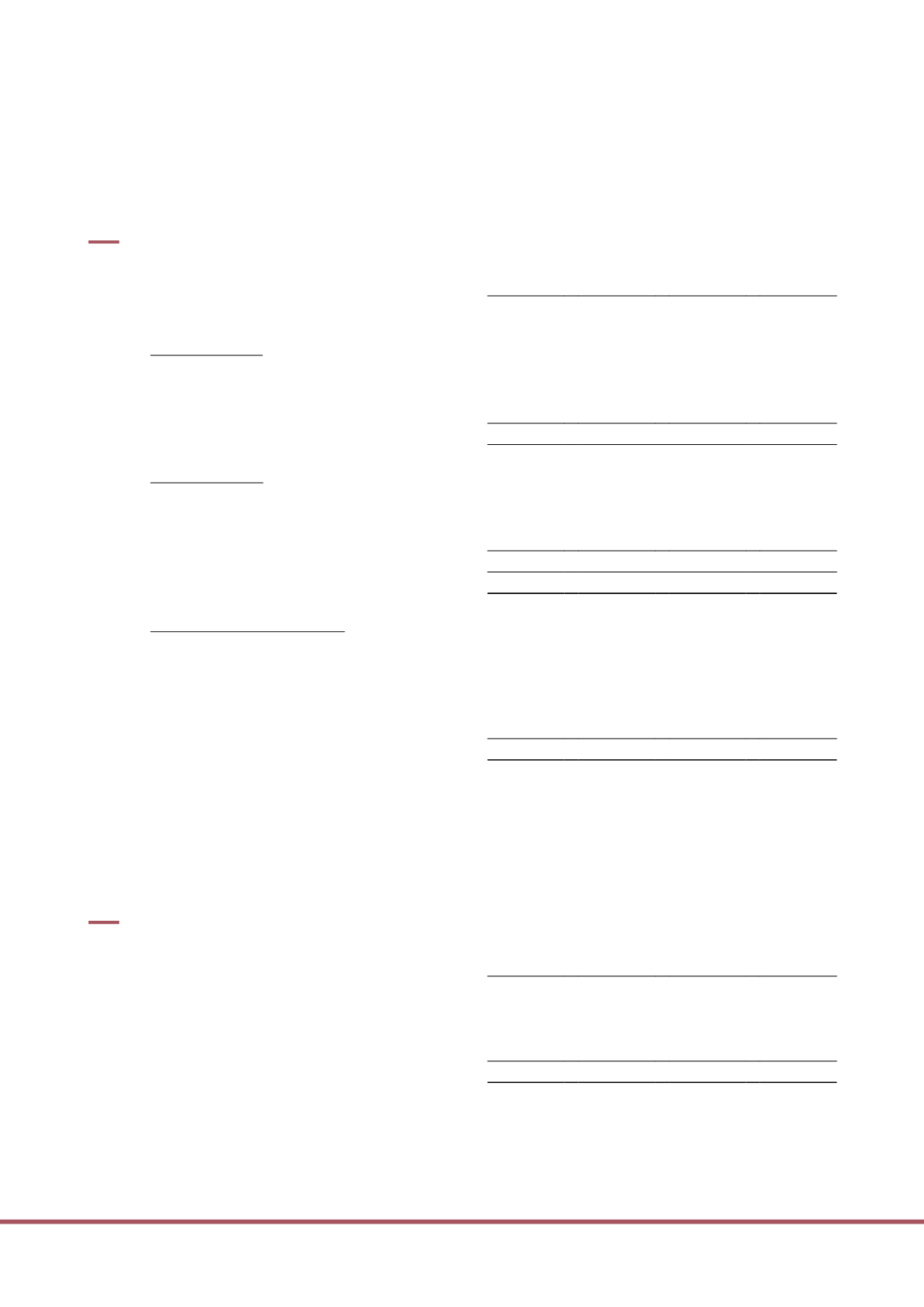

17.

TRADE AND OTHER RECEIVABLES

Group

Trust

2015

2014

2015

2014

$’000

$’000

$’000

$’000

Trade receivables:

Outside parties

10,182

4,442

244

448

Less: Allowance for impairment

(2,917)

(310)

–

–

Related parties (Note 3)

1,569

1,001

–

–

Subtotal

8,834

5,133

244

448

Other receivables:

Subsidiaries (Note 3)

–

–

188,074

189,146

Related parties (Note 3)

5,501

6,046

1,034

503

Other receivables

5,423

8,714

17

1,998

Subtotal

10,924

14,760

189,125

191,647

Total trade and other receivables

19,758

19,893

189,369

192,095

Movements in above allowance:

Balance at beginning of the year

(310)

(298)

–

–

Bad debt (written-off)/written back

(2)

212

–

–

Charge for trade receivables to profit or loss included

in property operating expenses (Note 5)

(2,615)

(218)

–

–

Effect of changes in exchange rates

10

(6)

–

–

Balance at end of the year

(2,917)

(310)

–

–

Concentration of credit risk relating to trade receivables is limited due to the Group’s many varied tenants and

credit policy of obtaining security deposits frommost tenants for leasing the Group’s investment properties. These

tenants comprise retailers engaged in a wide variety of consumer trades. The Group establishes an allowance for

impairment that represents its estimate of incurred losses in respect of trade receivables. Please refer to Note

28D for ageing analysis.

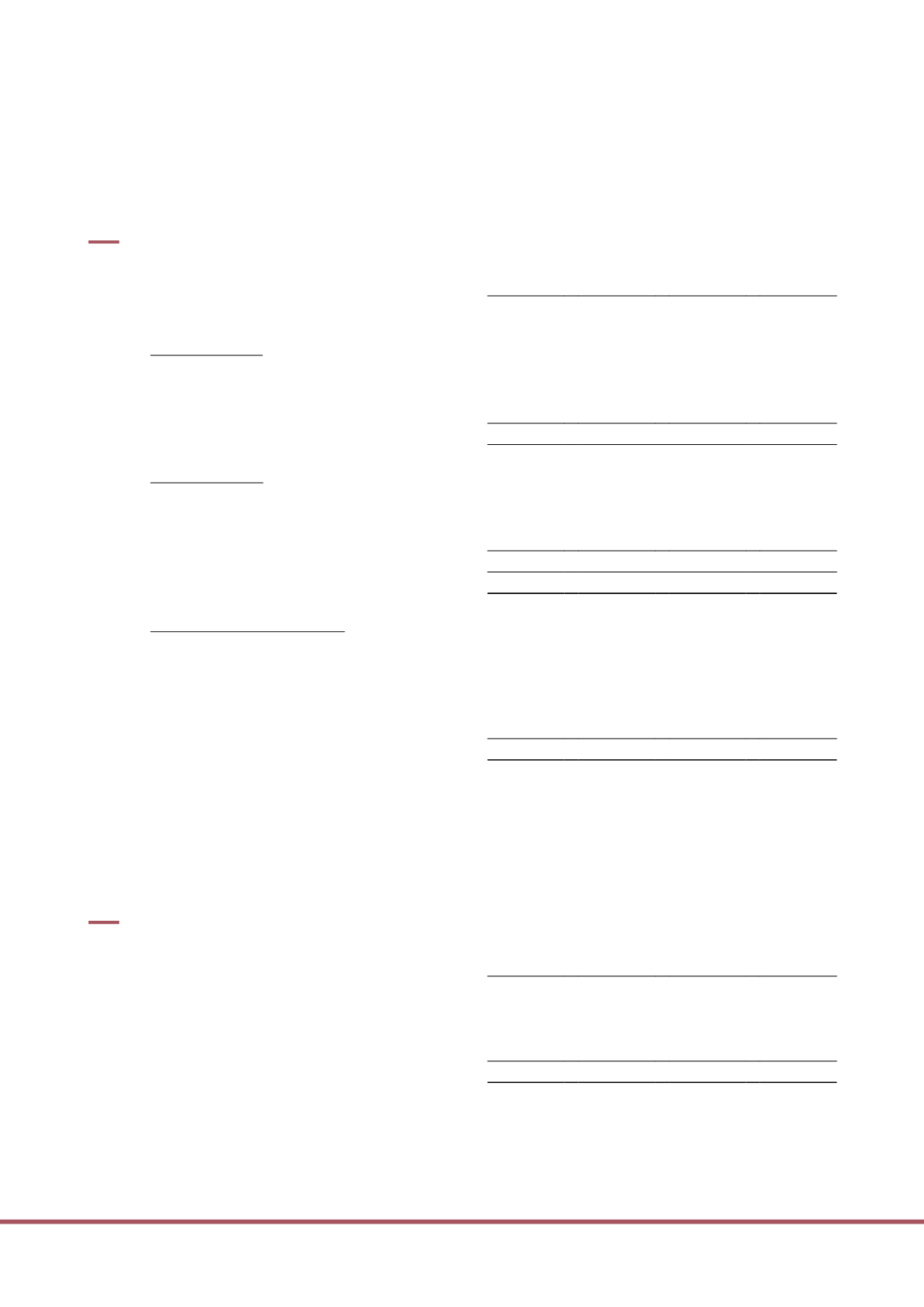

18.

OTHER ASSETS

Group

Trust

2015

2014

2015

2014

$’000

$’000

$’000

$’000

Prepayments

1,055

1,019

62

6

Prepaid tax

49,056

46,656

–

–

50,111

47,675

62

6

Prepaid tax includes prepaid VAT (“value-added tax”) amounting to $33,588,000 (2014: $34,781,000) relating to

the Lippo Mall Kemang that is recoverable from the relevant tax authority in Indonesia.

LIPPO MALLS INDONESIA RETAIL TRUST

108