NOTES TO THE FINANCIAL STATEMENTS

(CONT’D)

31 DECEMBER 2015

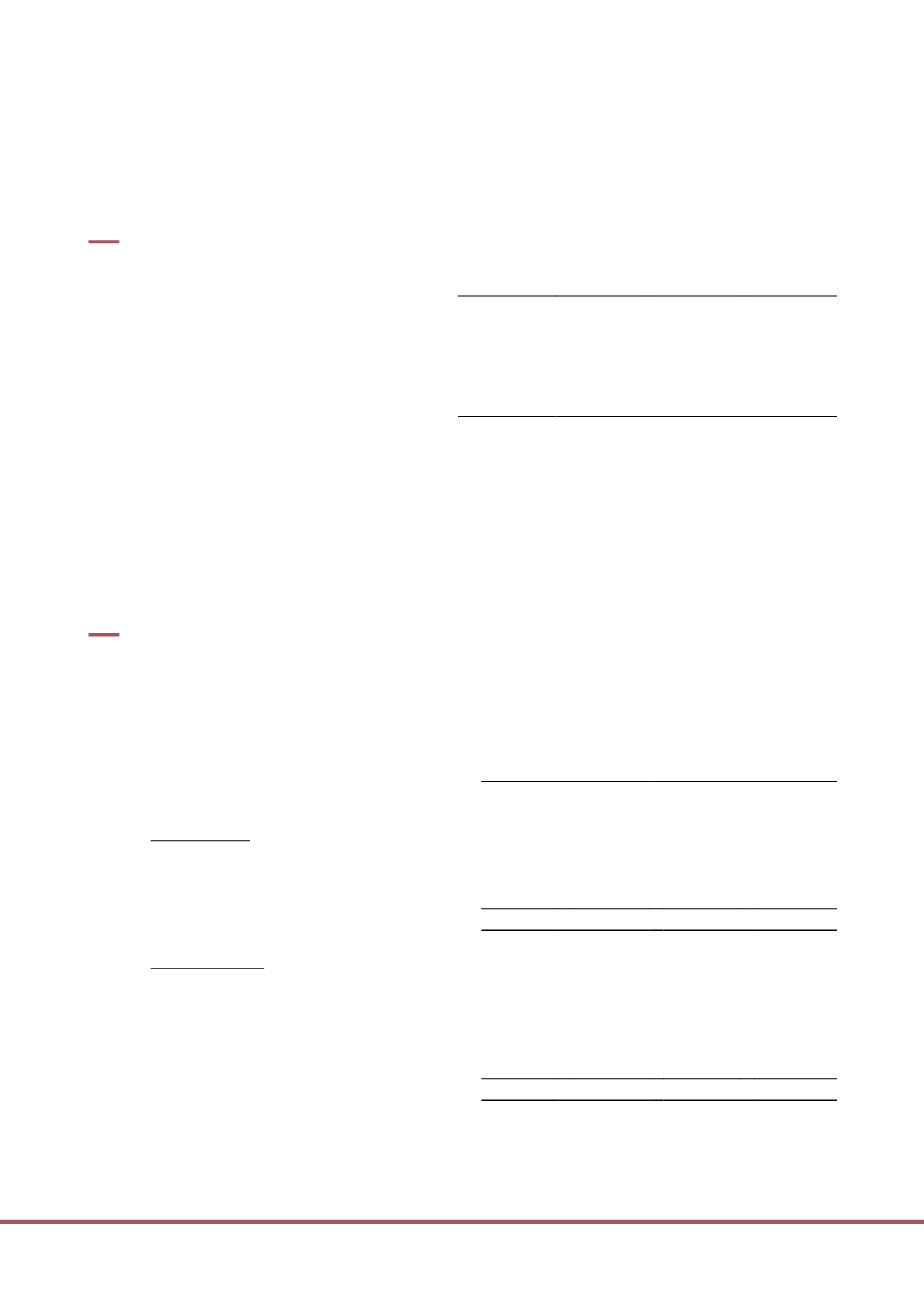

27.

FINANCIAL RATIOS

Group

Trust

2015

2014

2015

2014

Expenses to average net assets ratio – excluding

performance related fee

(1)

0.66%

0.56%

0.62%

0.52%

Expenses to average net assets ratio – including

performance related fee

(1)

1.23%

1.02%

1.18%

0.96%

Portfolio turnover ratio

(2)

–

–

–

–

(1)

The annualised ratios are computed in accordance with the guidelines of Investment Management

Association of Singapore. The expenses used in the computation relate to expenses at the Group and

Trust levels excluding any property related expenses, borrowing costs, foreign exchange losses/(gains),

tax deducted at source and costs associated with the purchase of investments.

(2)

Turnover ratio means the number of times per year that a dollar of assets is reinvested. It is calculated

based on the lesser of purchases or sales of underlying investments of a scheme expressed as a

percentage of daily average net asset value.

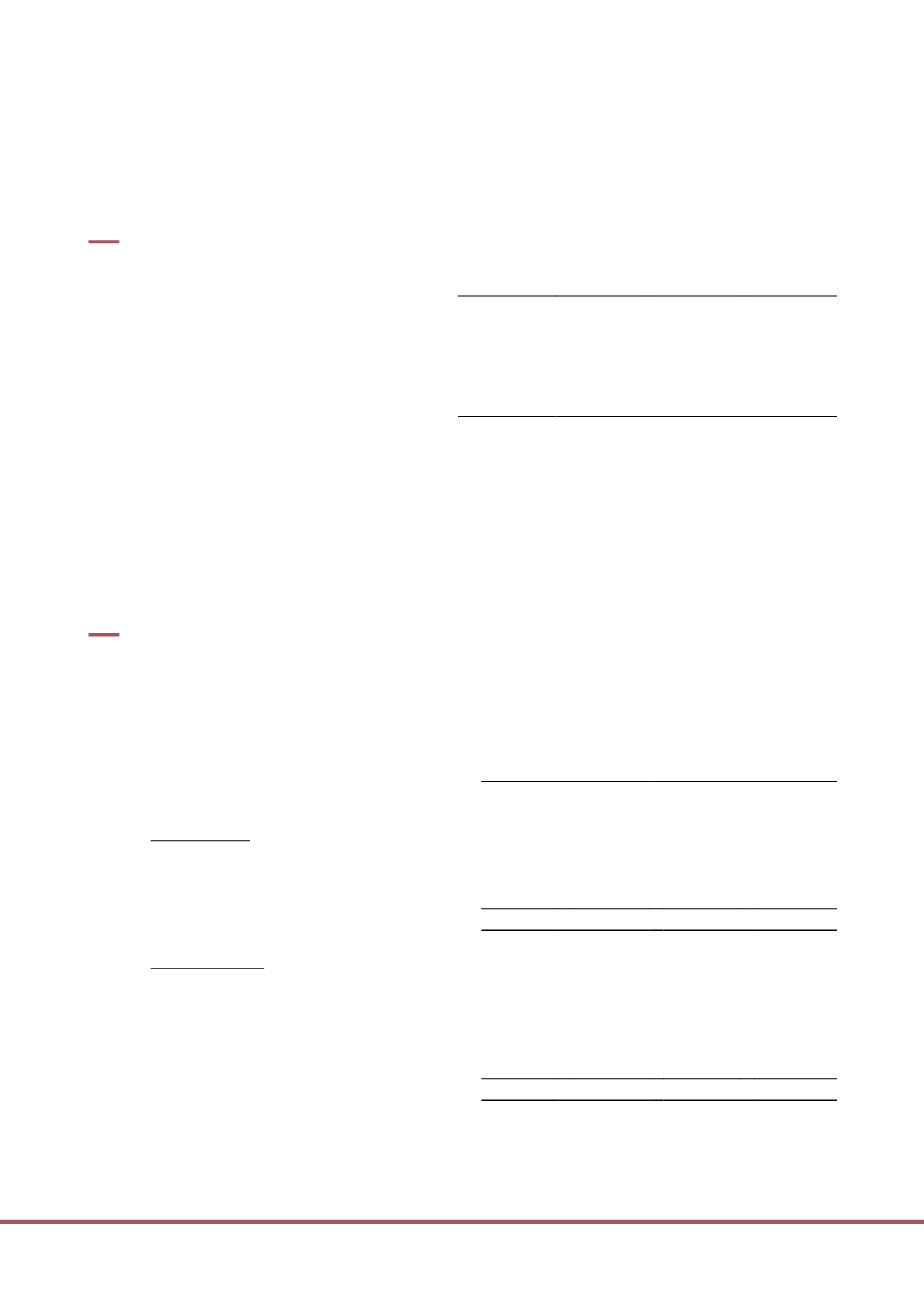

28.

FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS

28A.

Classification of financial assets and liabilities

The following table summarises the carrying amount of financial assets and liabilities recorded at the end of the

reporting year by FRS 39 categories:

Group

Trust

2015

2014

2015

2014

$’000

$’000

$’000

$’000

Financial assets:

Cash and cash equivalents

80,590

103,920

22,554

18,589

Loans and receivables

19,758

19,893

189,369

192,095

Financial assets at fair value through profit or loss

1,906

116

1,906

116

At end of the year

102,254

123,929

213,829

210,800

Financial liabilities:

Financial liabilities at fair value through profit or loss

687

146

687

146

Measured at amortised cost:

- Borrowings

687,001

622,832

141,930

151,473

- Trade and other payables

60,205

70,982

699,120

608,920

- Finance leases

2,011

1,527

–

–

At end of the year

749,904

695,487

841,737

760,539

Further quantitative disclosures are included throughout these financial statements.

LIPPO MALLS INDONESIA RETAIL TRUST

124