NOTES TO THE FINANCIAL STATEMENTS

(CONT’D)

31 DECEMBER 2015

28.

FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS (CONT’D)

28E.

Liquidity risk – financial liabilities maturity analysis (cont’d)

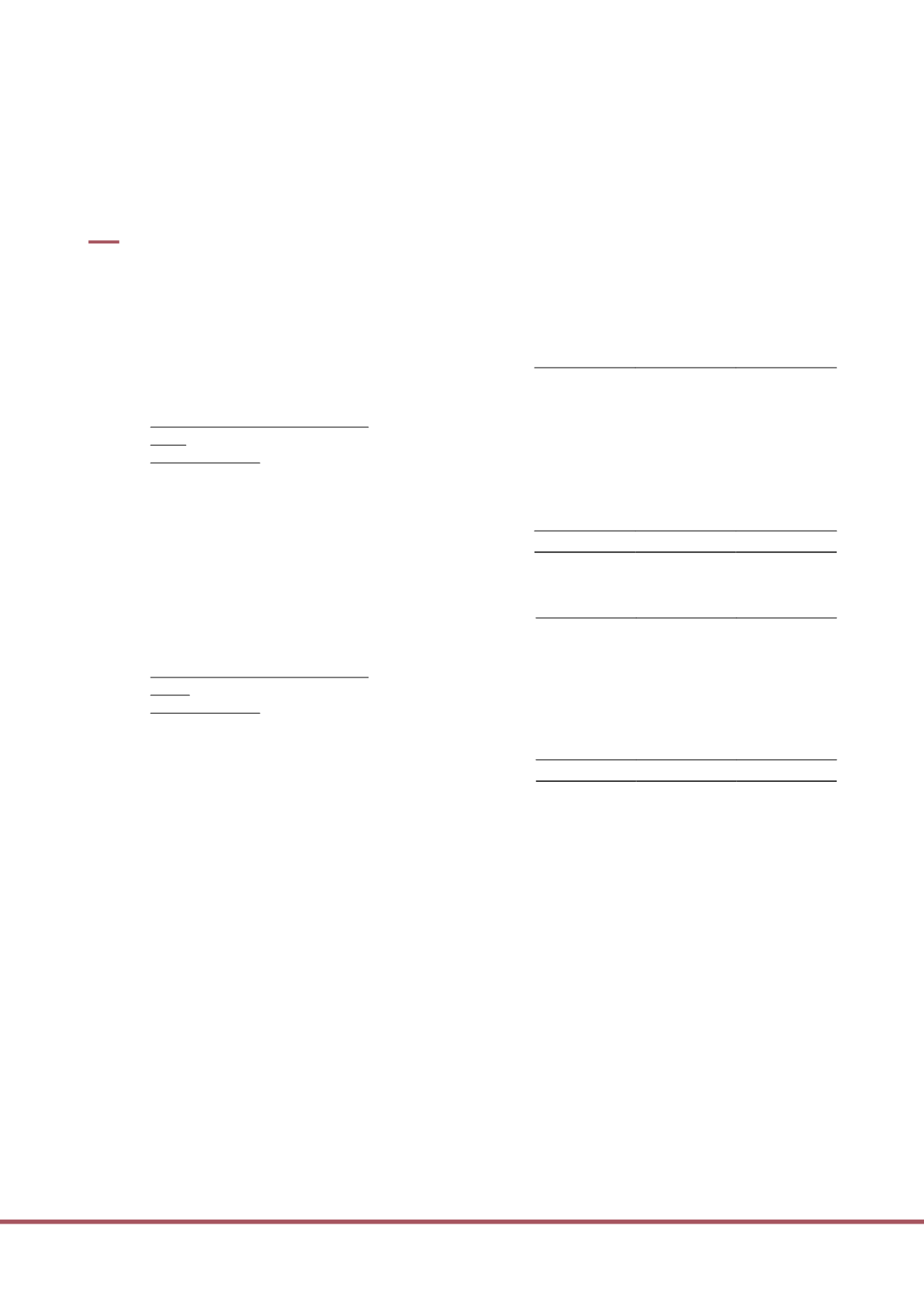

The following table analyses the derivative financial instruments by remaining contractual maturity:

Less than

1 year

1 to 3

years

Total

$’000

$’000

$’000

Derivative financial instruments:

2015:

Group and Trust

Net settled:

Currency option contracts

–

472

472

Interest rate swaps

–

(1,691)

(1,691)

At end of the year

–

(1,219)

(1,219)

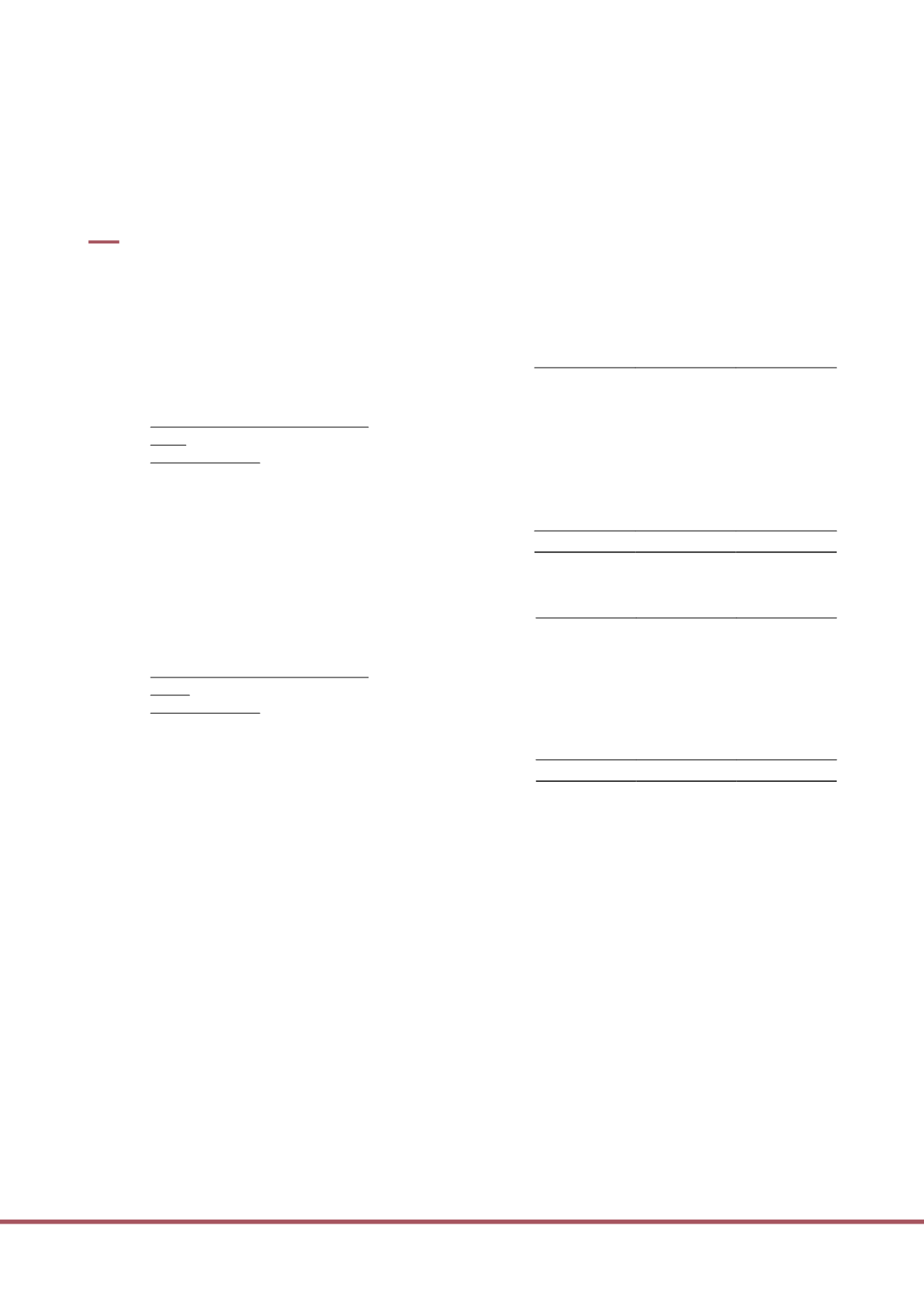

Less than

1 year

1 to 3

years

Total

$’000

$’000

$’000

Derivative financial instruments:

2014:

Group and Trust

Net settled:

Currency option contracts

30

–

30

At end of the year

30

–

30

The above amounts disclosed in the maturity analysis are the contractual undiscounted cash flows and such

undiscounted cash flows differ from the amount included in the statement of financial position. When the

counterparty has a choice of when an amount is paid, the liability is included on the basis of the earliest date on

which it can be required to pay.

The liquidity risk refers to the difficulty in meeting obligations associated with financial liabilities that are settled

by delivering cash or another financial asset. It is expected that all the liabilities will be settled at their contractual

maturity. The average credit period taken to settle trade payables is about 30 (2014: 30) days. The other payables

are with short-term durations. The classification of the financial assets is shown in the statements of financial

position as they may be available to meet liquidity need and no further analysis is deemed necessary.

A schedule showing the maturity of financial liabilities and unused bank facilities is provided regularly to

management of the Manager to assist in monitoring the liquidity risk. The Manager also monitors and observes

the Code on Collective Investment Schemes issued by the Monetary Authority of Singapore concerning limits

on total borrowings. The Manager is of the view that cash from operating activities will be sufficient to meet the

current requirements to support ongoing operations, capital expenditures, and debt repayment obligations.

The Trust’s structure necessitates raising funds through debt financing and the capital markets to fund strategic

acquisitions and capital expenditures. The Manager also ensures that there are sufficient funds for declared and

payable distributions and any other commitments.

LIPPO MALLS INDONESIA RETAIL TRUST

128