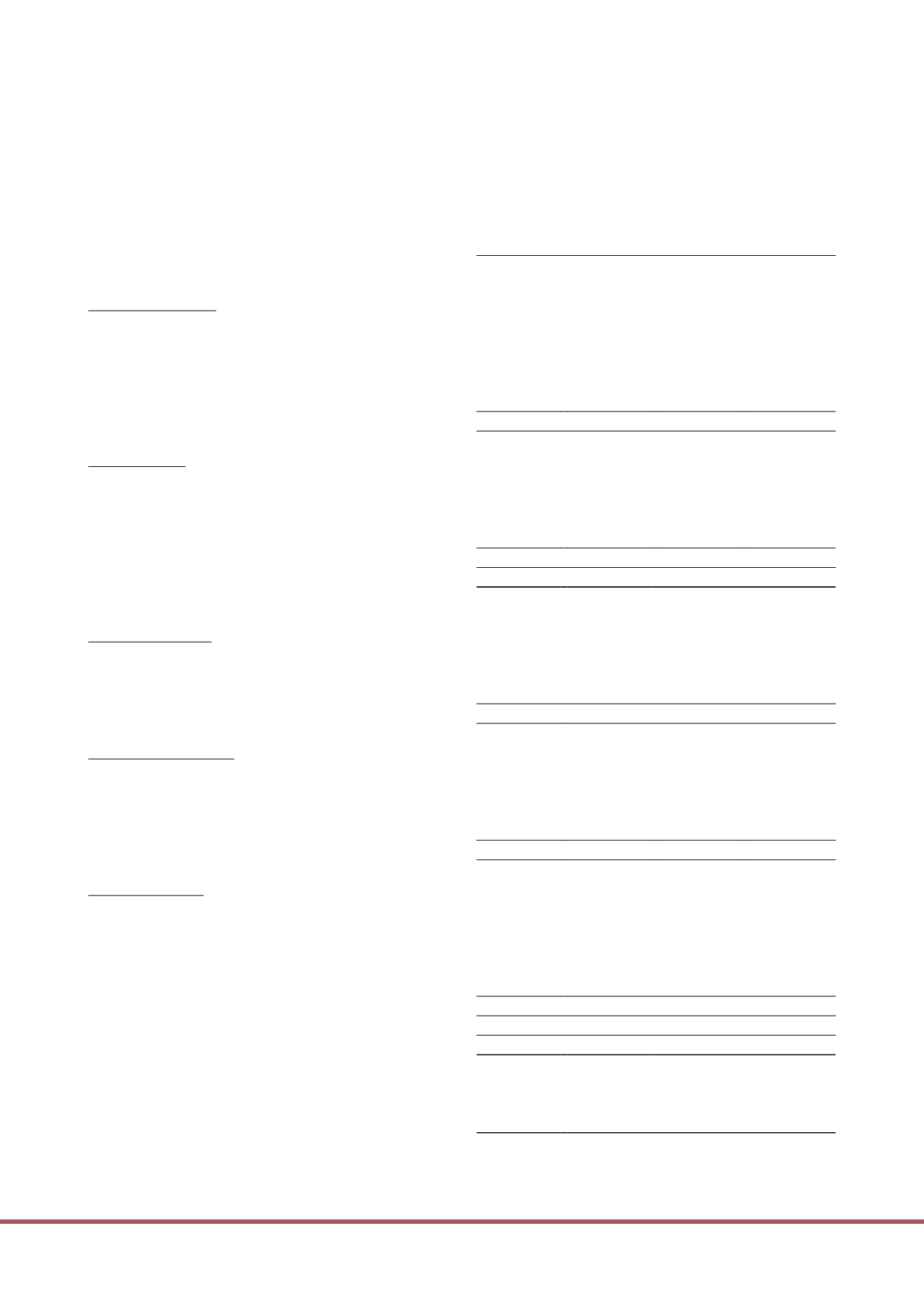

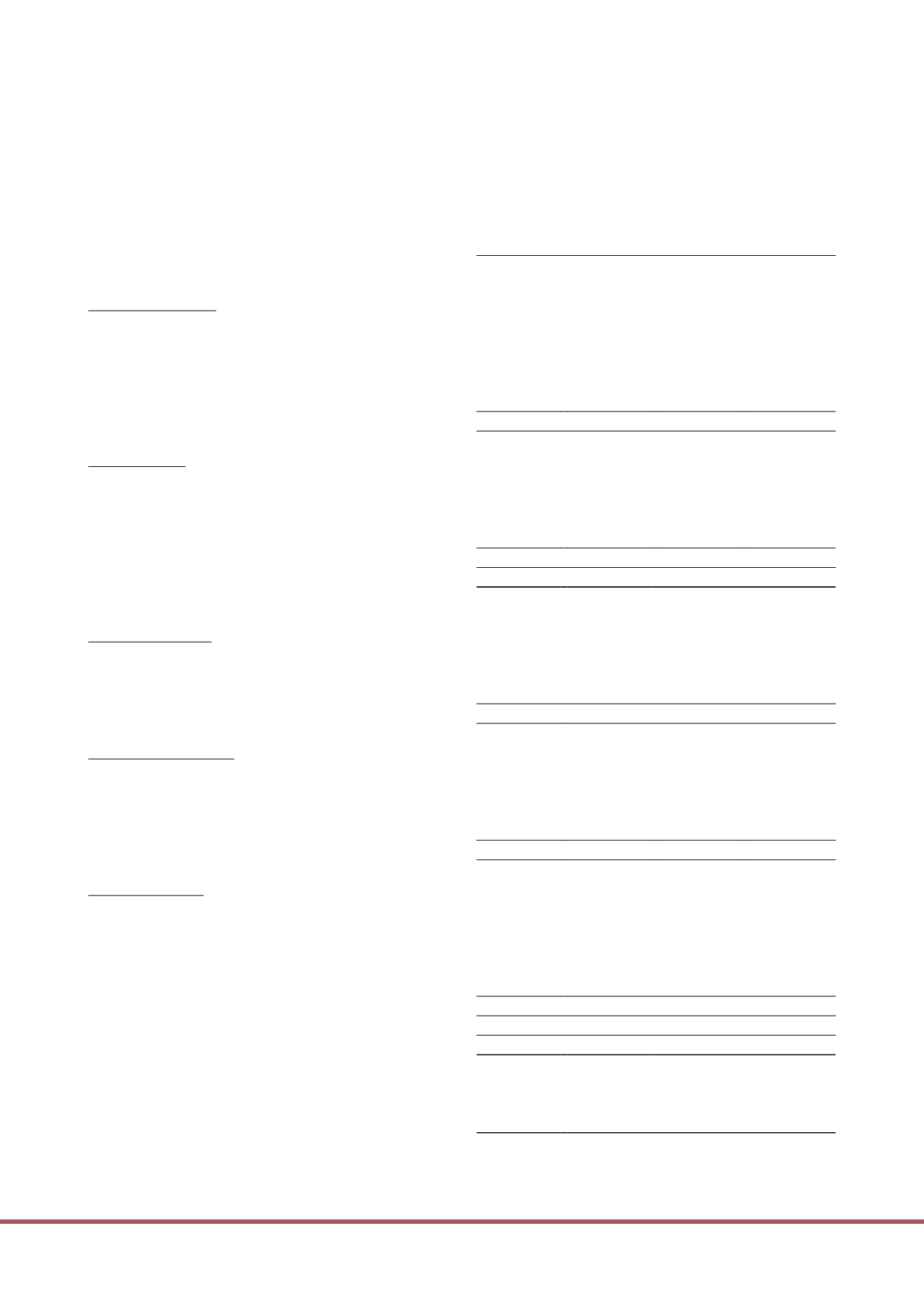

Group

Trust

Notes

2015

2014

2015

2014

$’000

$’000

$’000

$’000

ASSETS

Non-current assets

Plant and equipment

13

5,337

4,908

–

–

Investment properties

14 1,804,930 1,806,944

–

–

Derivative financial instruments, non-current

26

1,906

–

1,906

–

Intangible assets

15

25,112

34,033

–

–

Investments in subsidiaries

16

–

–

1,746,570 1,723,517

Total non-current assets

1,837,285 1,845,885 1,748,476 1,723,517

Current assets

Trade and other receivables

17

19,758

19,893

189,369

192,095

Other assets

18

50,111

47,675

62

6

Derivative financial instruments, current

26

–

116

–

116

Cash and cash equivalents

19

80,590

103,920

22,554

18,589

Total current assets

150,459

171,604

211,985

210,806

Total assets

1,987,744 2,017,489 1,960,461 1,934,323

UNITHOLDERS’ FUNDS AND LIABILITIES

Unitholders’ funds

Issued equity

1,392,034 1,357,399 1,392,034 1,357,399

Retained earnings/(accumulated losses)

237,593

291,603 (273,310)

(184,081)

Foreign currency translation reserve (adverse balance)

(554,512)

(499,272)

–

–

Total Unitholders’ funds

20 1,075,115 1,149,730 1,118,724 1,173,318

Non-current liabilities

Deferred tax liabilities

10

39,224

51,107

–

–

Other financial liabilities, non-current

22

439,491

425,365

141,930

151,473

Other liabilities, non-current

23

83,306

86,009

–

–

Derivative financial instruments, non-current

26

687

–

687

–

Total non-current liabilities

562,708

562,481

142,617

151,473

Current liabilities

Income tax payable

6,871

6,538

–

466

Trade and other payables, current

24

60,205

70,982

699,120

608,920

Other financial liabilities, current

22

249,521

198,994

–

–

Other liabilities, current

25

33,324

28,618

–

–

Derivative financial instruments, current

26

–

146

–

146

Total current liabilities

349,921

305,278

699,120

609,532

Total liabilities

912,629

867,759

841,737

761,005

Total Unitholders’ funds and liabilities

1,987,744 2,017,489 1,960,461 1,934,323

Cents

Cents

Cents

Cents

Net asset value per unit in cents

20

38.43

42.55

39.99

43.43

STATEMENTS OF FINANCIAL POSITION

AS AT 31 DECEMBER 2015

The accompanying notes form an integral part of these financial statements.

ANNUAL REPORT 2015

65