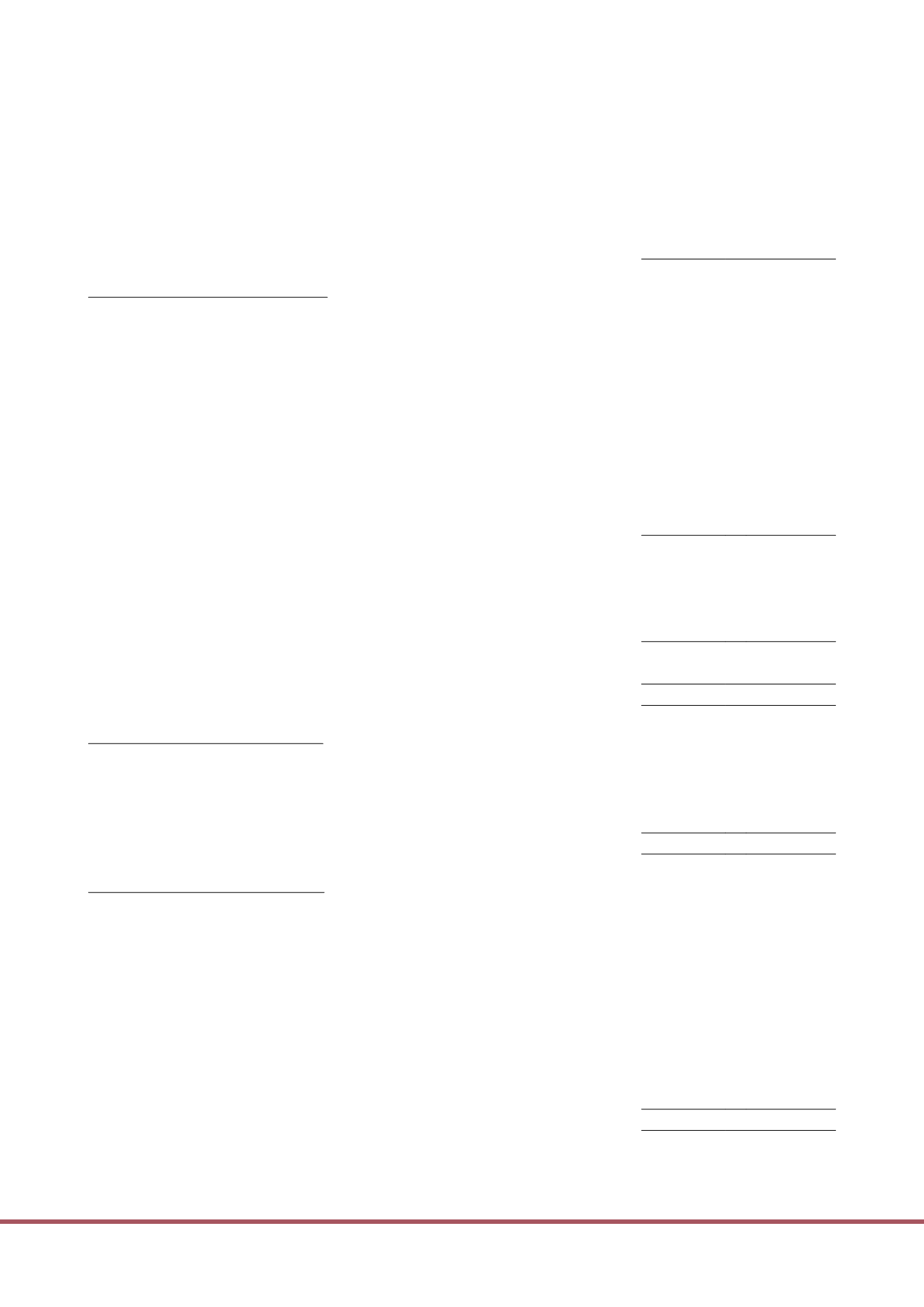

Group

2015

2014

$’000

$’000

Cash flows from operating activities

Total return before tax

44,277

89,915

Adjustments for:

Interest income

(2,201)

(2,925)

Interest expense

38,808

29,767

Amortisation of borrowing costs

5,600

4,642

Depreciation of plant and equipment

1,058

726

Amortisation of intangible assets

11,374

–

Decrease/(increase) in fair values of investment properties

53,316

(4,536)

Fair value gains on derivative financial instruments

(1,219)

(221)

Unrealised foreign exchange adjustment losses

116

1,363

Manager’s management fees settled in units

6,343

5,040

Operating cash flows before changes in working capital

157,472

123,771

Trade and other receivables

(2,383)

(5,755)

Other assets

4,072

(35,275)

Trade and other payables

(9,919)

42,726

Other liabilities, current

5,688

3,329

Net cash flows from operations before tax

154,930

128,796

Income tax paid

(29,584)

(26,598)

Net cash flows from operating activities

125,346

102,198

Cash flows from investing activities

Acquisition of investment properties

(1)

(79,359)

(317,000)

Capital expenditure on investment properties

(8,220)

(5,654)

Purchase of plant and equipment

(1,648)

(2,232)

Interest received

2,201

2,925

Net cash flows used in investing activities

(87,026)

(321,961)

Cash flows from financing activities

Repayment of bank borrowings

(110,000)

(147,500)

Proceeds from bank borrowings

200,000

155,000

Repayment of notes issued under EMTN

(200,000)

–

Proceeds from notes issued under Programmes

175,000

–

Net proceeds from issuance of new units

(1)

–

38,145

Distributions to Unitholders

(80,458)

(64,224)

Other financial liabilities, current

(2)

(5,219)

(3,699)

Other financial liabilities, non-current

(2)

(874)

–

Other liabilities, non-current

248

3,649

Interest paid

(38,808)

(29,767)

Net cash flows used in financing activities

(60,111)

(48,396)

STATEMENT OF CASH FLOWS

YEAR ENDED 31 DECEMBER 2015

The accompanying notes form an integral part of these financial statements.

ANNUAL REPORT 2015

67