111

LIPPO MALLS INDONESIA RETAIL TRUST ANNUAL REPORT 2014

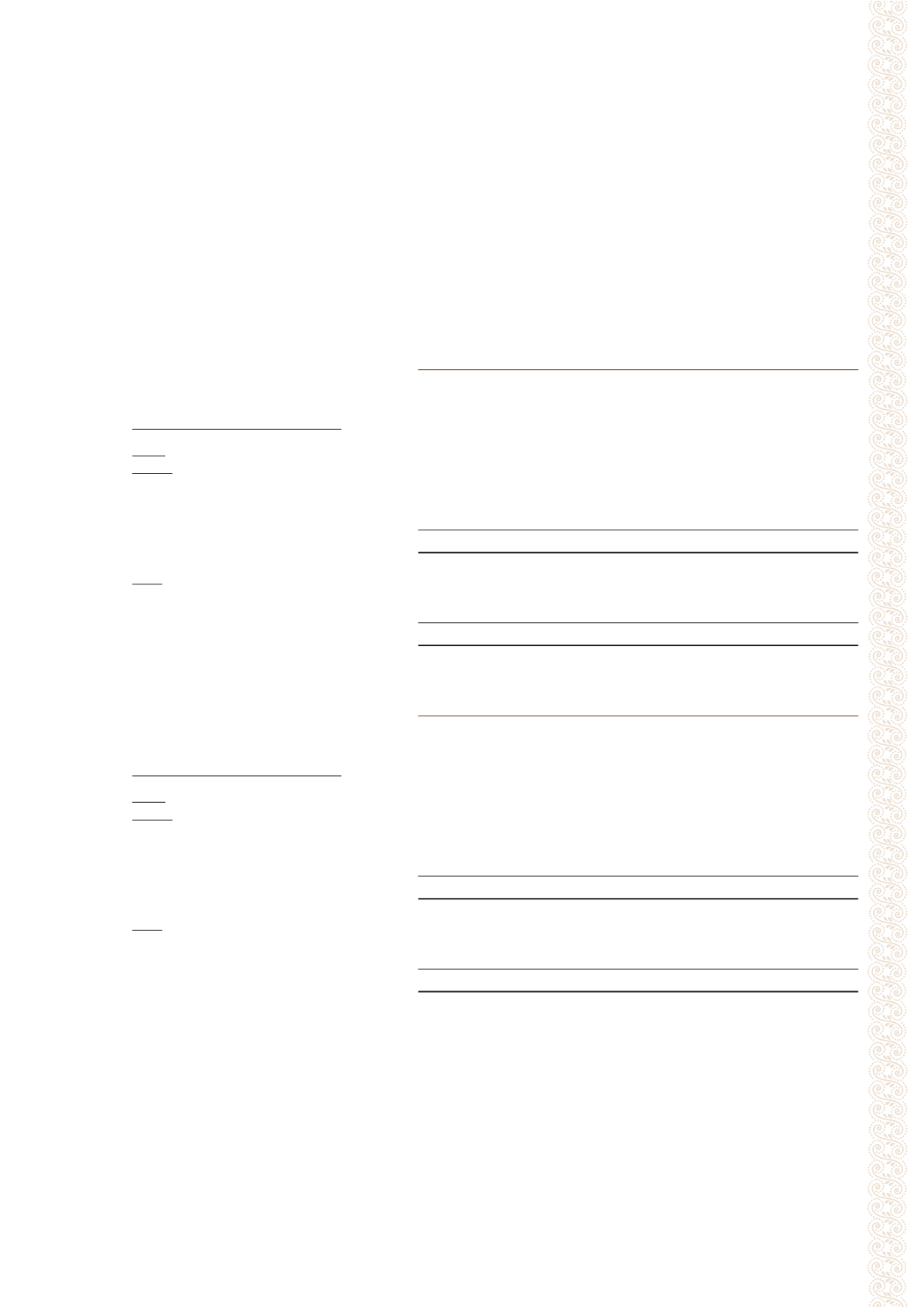

28. FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS (CONT’D)

28E. Liquidity risk – financial liabilities maturity analysis

The following table analyses non-derivative financial liabilities by remaining contractual maturity (contractual and

undiscounted cash flows):

Less than

1 year

1 to 3

years

3 to 5

years

Over

5 years

Total

$’000

$’000

$’000

$’000

$’000

Non-derivative financial liabilities:

2014

Group

Gross borrowings commitments

223,409

302,160

160,501

–

686,070

Gross finance lease obligations

41

397

267

1,240

1,945

Trade and other payables

70,982

–

–

–

70,982

At end of the year

294,432

302,557

160,768

1,240

758,997

Trust

Gross borrowings commitments

5,737

11,473

160,501

–

177,711

Trade and other payables

608,920

–

–

–

608,920

At end of the year

614,657

11,473

160,501

–

786,631

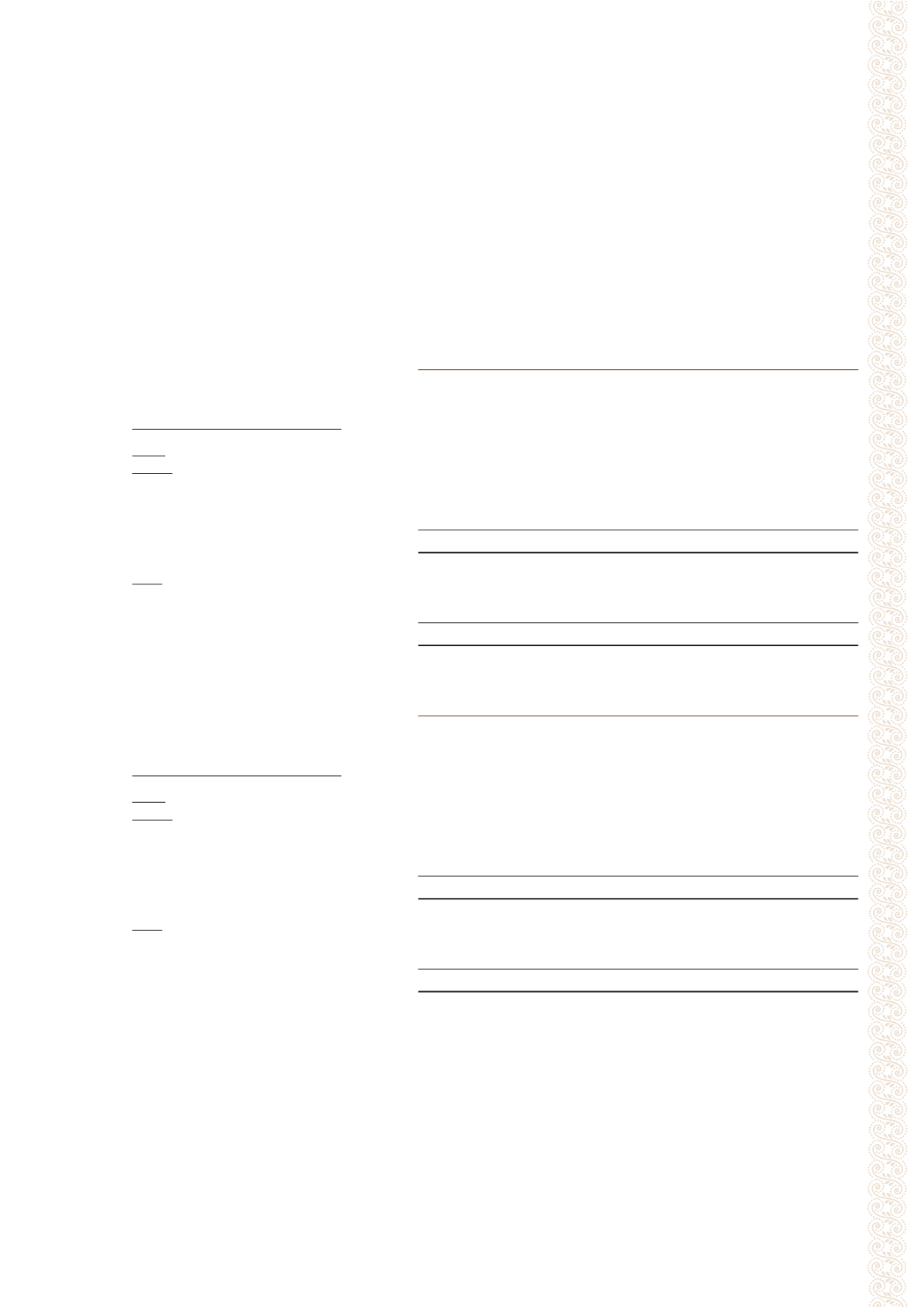

Less than

1 year

1 to 3

years

3 to 5

years

Over

5 years

Total

$’000

$’000

$’000

$’000

$’000

Non-derivative financial liabilities:

2013

Group

Gross borrowings commitments

172,717

378,809

129,561

–

681,087

Gross finance lease obligations

38

387

189

1,306

1,920

Trade and other payables

24,222

–

–

–

24,222

At end of the year

196,977

379,196

129,750

1,306

707,229

Trust

Gross borrowings commitments

150,285

–

–

–

150,285

Trade and other payables

384,518

–

–

–

384,518

At end of the year

534,803

–

–

–

534,803

Notes to the Financial Statements

(Cont’d)

31 December 2014