112

LIPPO MALLS INDONESIA RETAIL TRUST ANNUAL REPORT 2014

28. FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS (CONT’D)

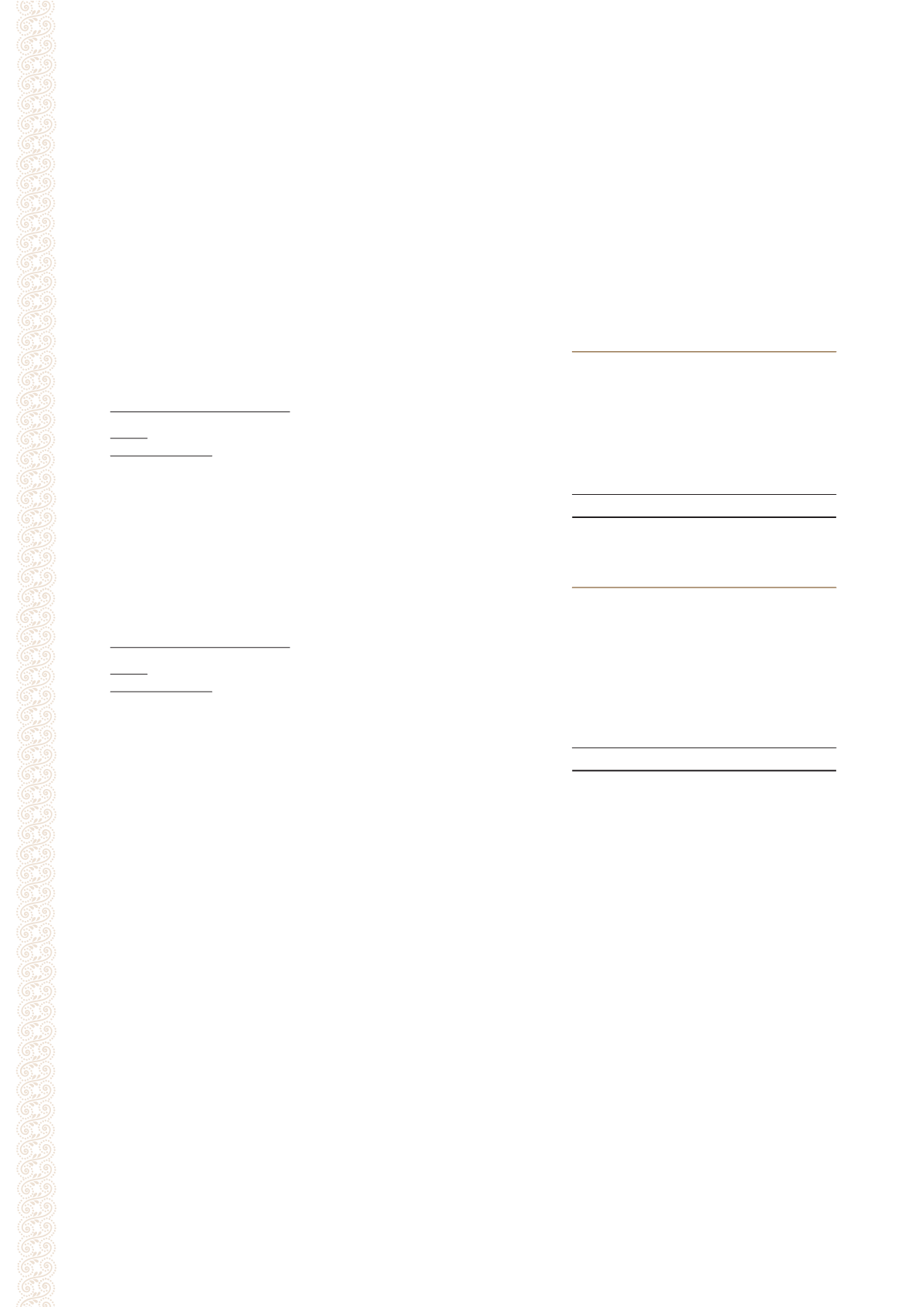

28E. Liquidity risk – financial liabilities maturity analysis (Cont’d)

The following table analyses the derivative financial liabilities by remaining contractual maturity:

Less than

1 year

1 to 3

years

Total

$’000

$’000

$’000

Derivative financial liabilities:

2014:

Group and Trust

Net settled:

Currency option contracts

(30)

–

(30)

At end of the year

(30)

–

(30)

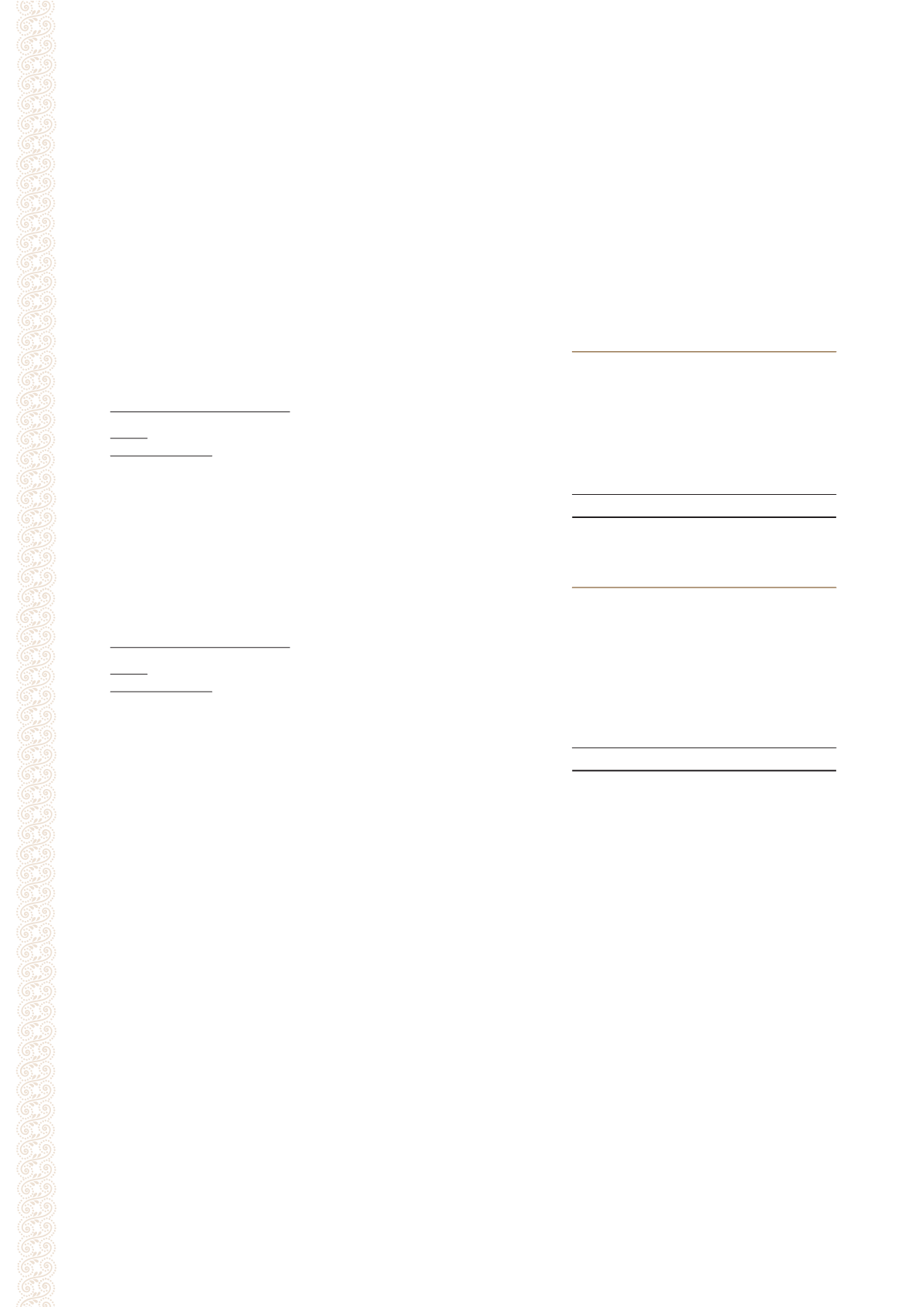

Less than

1 year

1 to 3

years

Total

$’000

$’000

$’000

Derivative financial liabilities:

2013:

Group and Trust

Net settled:

Currency option contracts

(278)

216

(62)

Interest rate swap

312

–

312

At end of the year

34

216

250

The above amounts disclosed in the maturity analysis are the contractual undiscounted cash flows and such undiscounted

cash flows differ from the amount included in the statement of financial position. When the counterparty has a choice

of when an amount is paid, the liability is included on the basis of the earliest date on which it can be required to pay.

The liquidity risk is managed on the basis of expected maturity dates of the financial liabilities. The average credit

period taken to settle trade payables is about 30 days. The other payables are with short-term durations. Apart from

the classification of the assets in the statement of financial position, no further analysis is deemed necessary.

A schedule showing the maturity of financial liabilities and unused bank facilities is provided regularly to management

of Manager to assist in monitoring the liquidity risk. The Manager also monitors and observes the Code on Collective

Investment Schemes issued by the Monetary Authority of Singapore concerning limits on total borrowings.

Notes to the Financial Statements

(Cont’d)

31 December 2014