115

LIPPO MALLS INDONESIA RETAIL TRUST ANNUAL REPORT 2014

28. FINANCIAL INSTRUMENTS: INFORMATION ON FINANCIAL RISKS (CONT’D)

28G. Foreign currency risk (Cont’d)

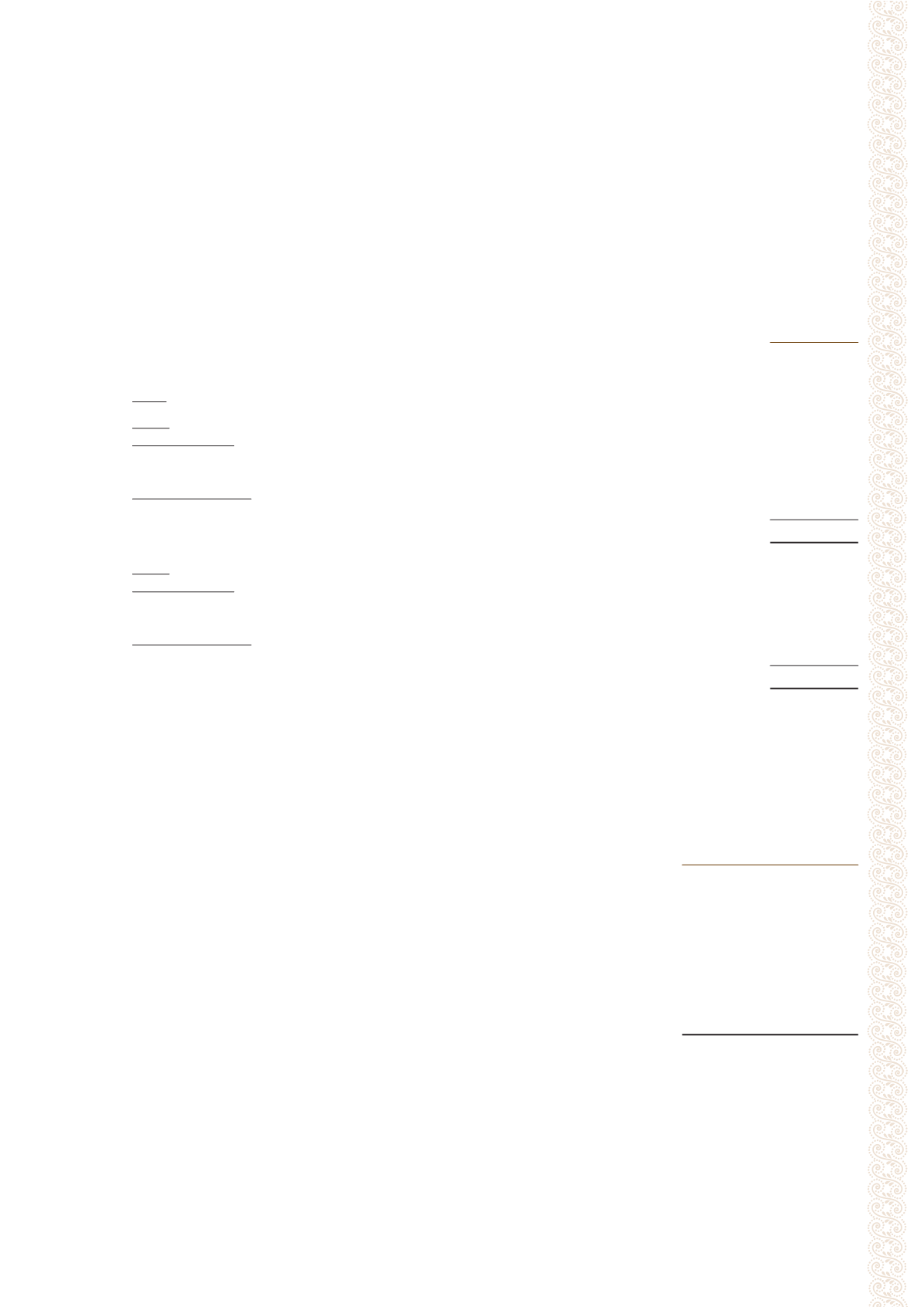

Indonesian

Rupiah

$’000

Trust

2014:

Financial Assets:

139,152

Trade and other receivables

Financial Liabilities:

Trade and other payables

12,622

Net financial assets at end of the year

126,530

2013:

Financial Assets:

Trade and other receivables

134,855

Financial Liabilities:

Trade and other payables

14,391

Net financial assets at end of the year

120,464

There is exposure to foreign currency risk as part of its normal business. In particular, there is significant exposure

to Indonesian Rupiah currency risk due to the operations of the malls in Indonesia. In this respect, foreign currency

contracts are entered into to take into consideration of anticipated revenues in Indonesian Rupiah over operating

expenses. Notes 26B and 26C illustrate the foreign currency derivatives in place at end of the reporting year.

Sensitivity analysis:

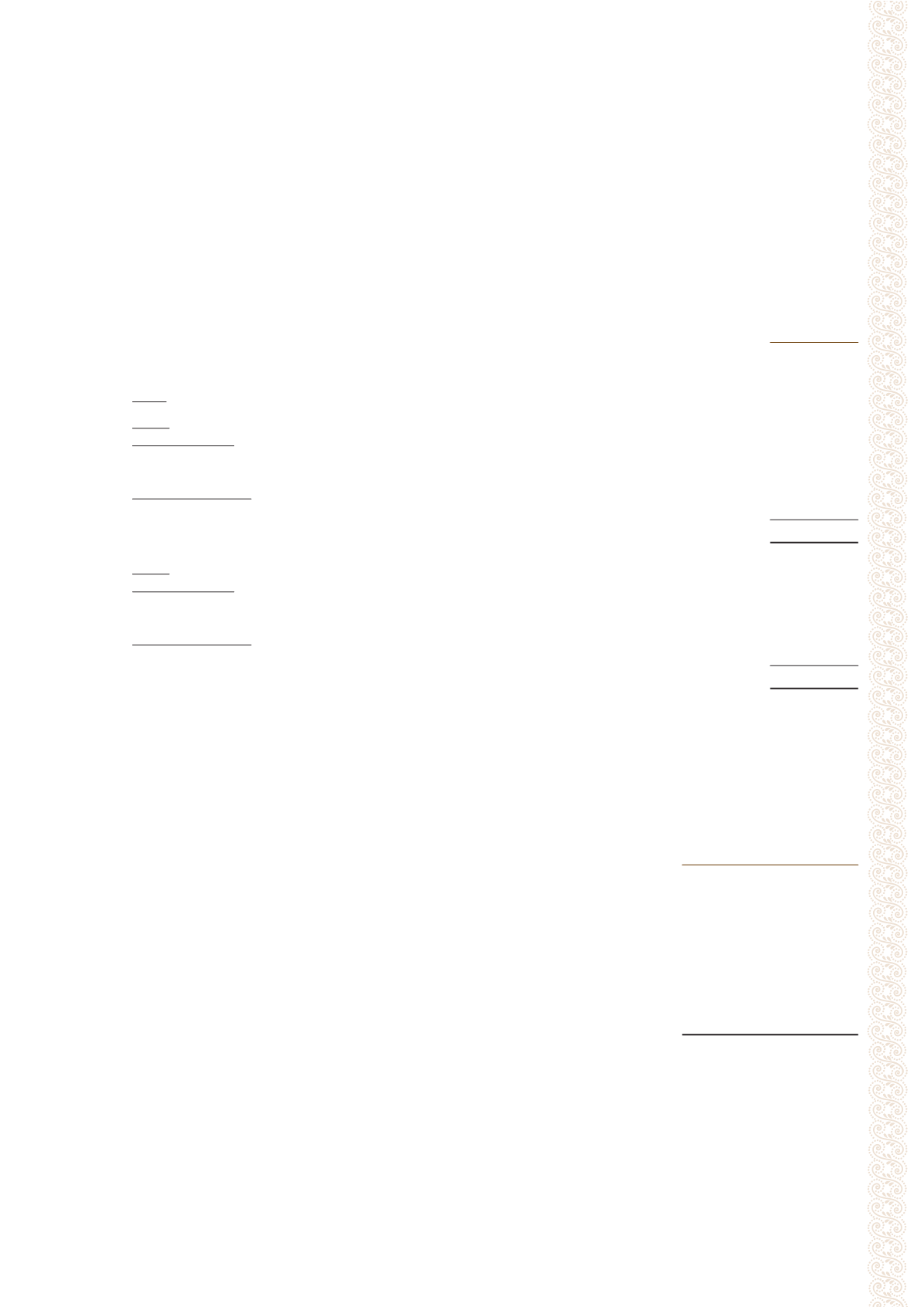

Group

2014

2013

$’000

$’000

A hypothetical 10% strengthening in the exchange rate of the functional currency

IDR against USD with all other variables held constant would have an

adverse effect on total return before tax of

(32)

(48)

A hypothetical 10% strengthening in the exchange rate of the functional currency

IDR against SGD with all other variables held constant would have an

adverse effect on total return before tax of

(1,746)

(8,040)

Notes to the Financial Statements

(Cont’d)

31 December 2014