MANAGER’S REPORT

Operations Review

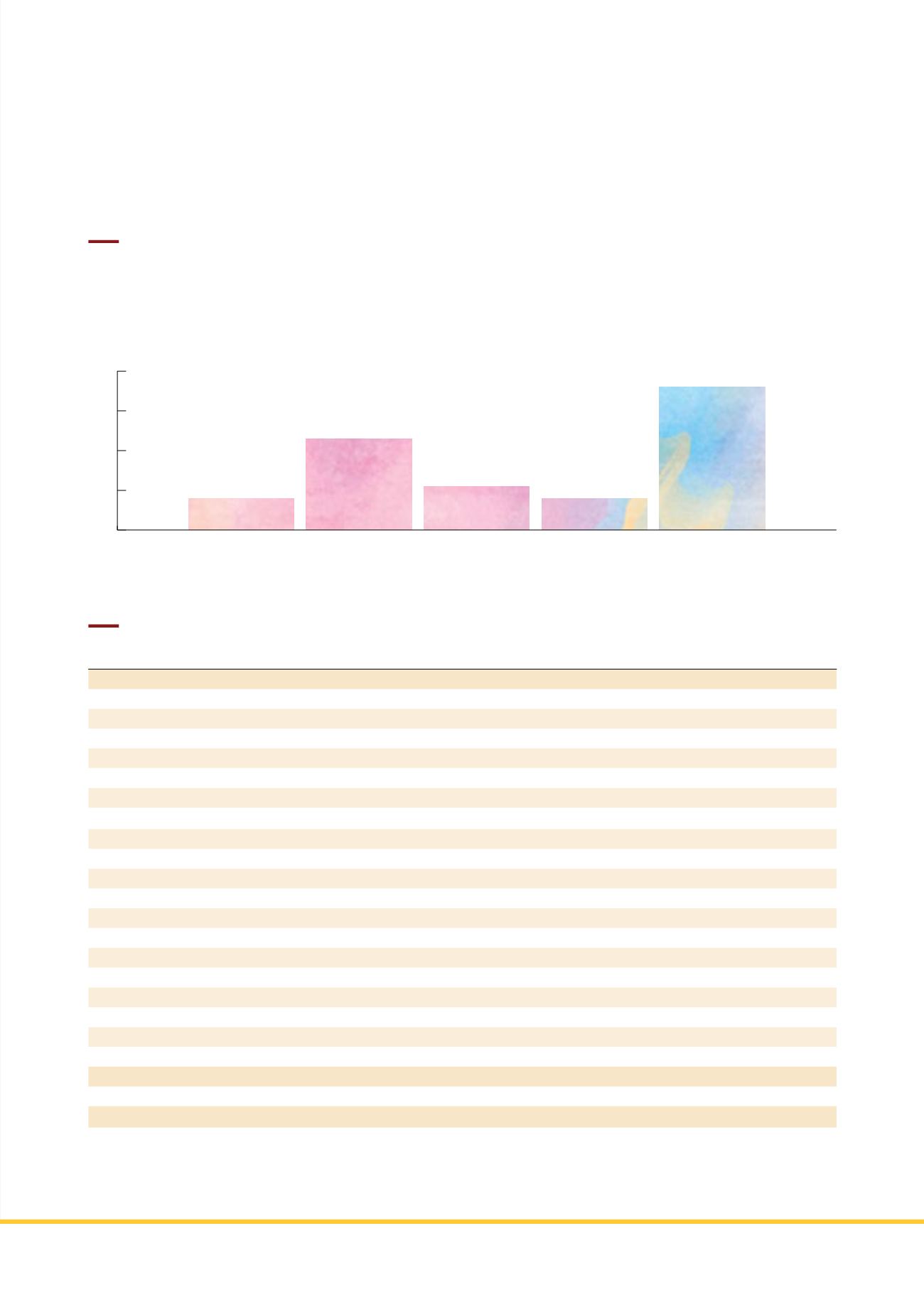

PORTFOLIO LEASE PROFILE

The average lease tenure for specialty tenants in our portfolio ranges between

three to five years whilst the same for anchor tenants is ten years. The total

weighted average lease term for the portfolio as of 31 December 2015 was 4.91

years. For new leases commencing in 2015, the weighted average lease expiry

as at 31 December 2015 was 3.83 years and accounted for 16.5% of the gross

rental income.

36%

8%

23%

11%

8%

2016

2017

2018

2019

2020 & Beyond

Lease Expiry Profile by NLA as at 31 December 2015

40%

30%

20%

10%

0%

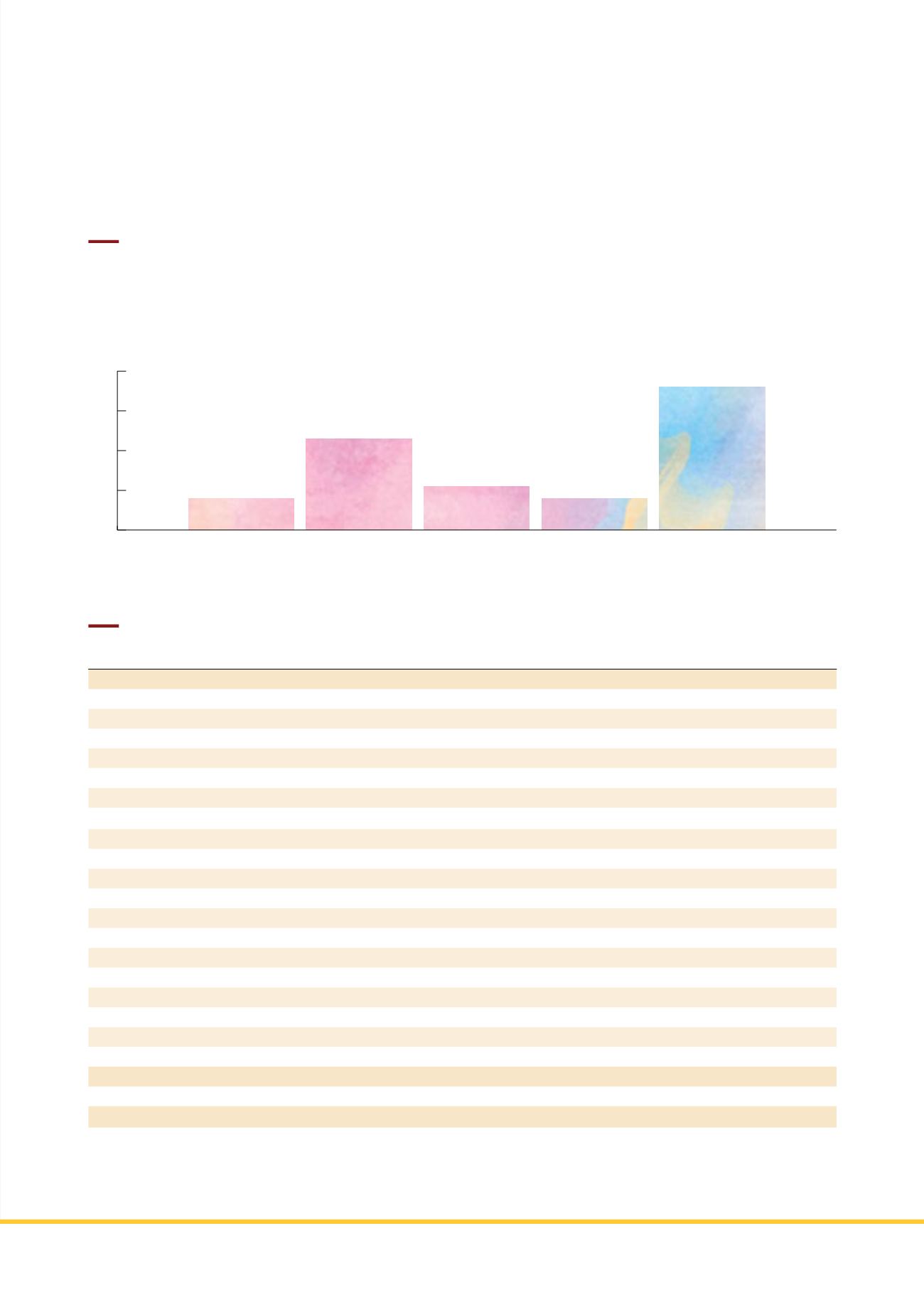

WEIGHTED AVERAGE OCCUPANCY

As of 31 December 2015, LMIR Trust’s portfolio occupancy of 94% remained higher

than the industry average of 84.7% as reported in Cushman & Wakefield’s 4th

Quarter 2015 MarketBeat report.

No.

Property

FY2015

*

FY2014

*

1

Bandung Indah Plaza

99.8%

99.9%

2

Cibubur Junction

99.0%

98.6%

3

Ekalokasari Plaza

92.3%

94.1%

4

Gajah Mada Plaza

75.9%

77.1%

5

Istana Plaza

100.0%

99.7%

6

Mal Lippo Cikarang

99.1%

99.9%

7

The Plaza Semanggi

80.2%

90.3%

8

Sun Plaza

98.3%

97.9%

9

Plaza Medan Fair

97.8%

97.8%

10 Pluit Village

87.7%

87.7%

11 Lippo Plaza Kramat Jati

91.9%

86.8%

12 Palembang Square Extension

94.4%

99.8%

13 Tamini Square

100.0%

100.0%

14 Palembang Square

92.6%

97.4%

15 Pejaten Village

99.0%

99.3%

16 Binjai Supermall

93.2%

90.4%

17 Lippo Mall Kemang

93.2%

93.2%

18 Lippo Plaza Batu**

98.3%

–

19 Palembang Icon**

99.3%

–

A Mall Portfolio

93.2%

93.9%

B Retail Spaces

100.0%

100.0%

A+B Total Portfolio

94.0%

94.7%

*

Include temporary leasing

** Newly acquired malls in 2015

ANNUAL REPORT 2015

27