A PRUDENT CAPITAL

MANAGEMENT STRATEGY

The Manager pursues a prudent

capital management strategy

through adopting and maintaining a

conservative gearing level as well as

an active currency and interest rate

management policy.

This strategy aims to:

• Optimize Unitholder’s returns;

• Provide stable returns to

Unitholders;

• Minimize refinancing risks;

• Maintain flexibility for working capital

requirements; and

• Retain flexibility in the funding of

future acquisitions.

HEDGING AGAINST INTEREST RATE

RISKS

It is the policy of the Manager to work

towards delivering stable and growing

returns through sourcing attractively

priced capital and adopting appropriate

hedging strategies.

LMIR Trust has in place interest rate

swap contracts for a period of 3.75

years commencing March 2015 to

hedge against the floating interest rate

of the borrowings of S$145 million.

As at 31 December 2015, more than

85% of LMIR Trust borrowings of S$695

million are on fixed rates.

HEDGING AGAINST FOREIGN

EXCHANGE RISKS

LMIR Trust has entered into foreign

exchange hedges to hedge its

estimated quarterly cash flows in

CAPITAL

MANAGEMENT

**

Based on total deposited assets as at 31 December 2015

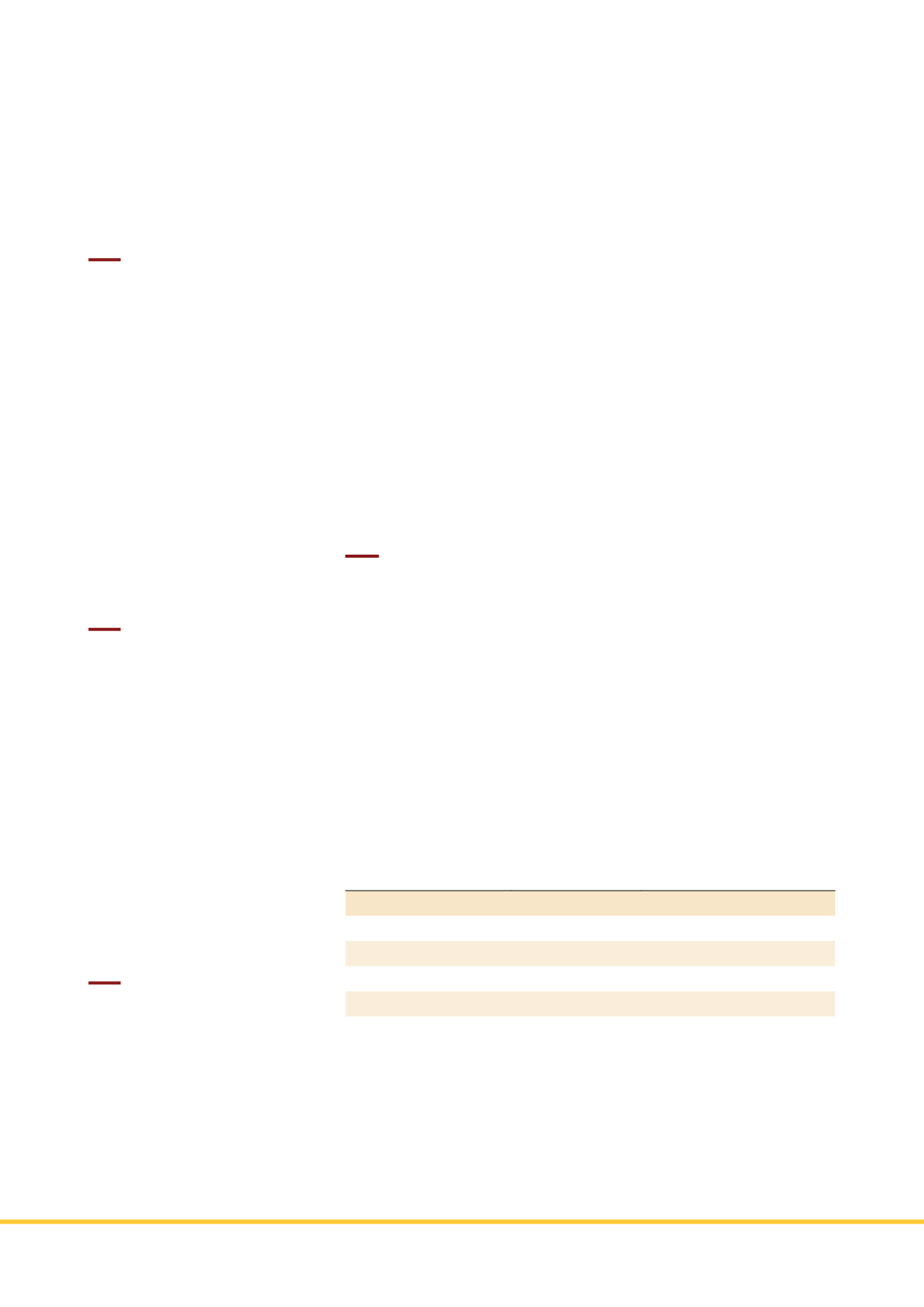

Amount

Coupon

Maturity Date

$150,000,000

4.250%

4 October 2016

$50,000,000

5.875%

6 July 2017

$75,000,000

4.480%

28 November 2017

$100,000,000

4.500%

23 November 2018

$75,000,000

4.100%

22 June 2020

Indonesian Rupiah until the end of

2016. The foreign exchange hedges

are entered into so as to provide a

degree of certainty that changes in the

exchange rate between the Indonesian

Rupiah and the Singapore Dollars will

not have a significant negative impact

on the distributions in Singapore

Dollars to Unitholders.

As at 31 December 2015, the mark

to market valuation of the foreign

exchange hedges is approximately

S$8.2 million.

MODERATE GEARING LEVEL

PROVIDES STABILITY IN CURRENT

TIGHT CREDIT MARKET

In September 2015, LMIR Trust

established a new S$1,000,000,000

Guaranteed Euro Medium Term

Securities Programme (EMTS

Programme), in addition to an existing

S$750,000,000 Guaranteed Euro

Medium Term Note Programme

(EMTN Programme) it established in

July 2012. The new S$1,000,000,000

EMTS Programme allows LMIR Trust to

issue notes and/ or perpetual securities

from time to time, thereby providing

LMIR Trust greater flexibility for its fund

raising whenever necessary.

The following notes had been issued

under the two Programmes to date :

During the financial year, a S$200

million 6-month bridging loan was drew

down to refinance the S$200 million

4.88% p.a. notes due in July 2015.

Such bridging loan was subsequently

refinanced by issuance of S$100million

notes in November 2015 and a S$100

million 3-year unsecured loan drew

down in January 2016.

At the same time, in June 2015, LMIR

Trust repaid S$10 million of a S$155

million 4-year loan which was used to

part finance the acquisition of Lippo

Mall Kemang in December 2014.

As at 31 December 2015, LMIR Trust’s

gearing ratio stood at 35%**, which is

well below the allowed leverage limit

of 60% for a REIT with credit rating.

Following the Monetary of Singapore’s

(MAS) regulatory changes to regime

governing REITs in Singapore, a REIT

is permitted to borrow up to 45.0% of

the value of its Deposited Property with

effect from 1 January 2016, regardless

of whether a credit rating is obtained.

LMIR Trust has continued to perform

in accordance with the debts provision

and have met all covenants to date.

The Manager will continue to focus on

prudent capital management strategy

by conserving cash through and

effective controls over operating and

capital expenditure.

LIPPO MALLS INDONESIA RETAIL TRUST

32